Question: ko Homework: Chapter 7. Stock Question 5, P7-9 (book/static) HW Score: 0%, 0 of 16 points Valuation Part 1 of 2 O Points: 0 of

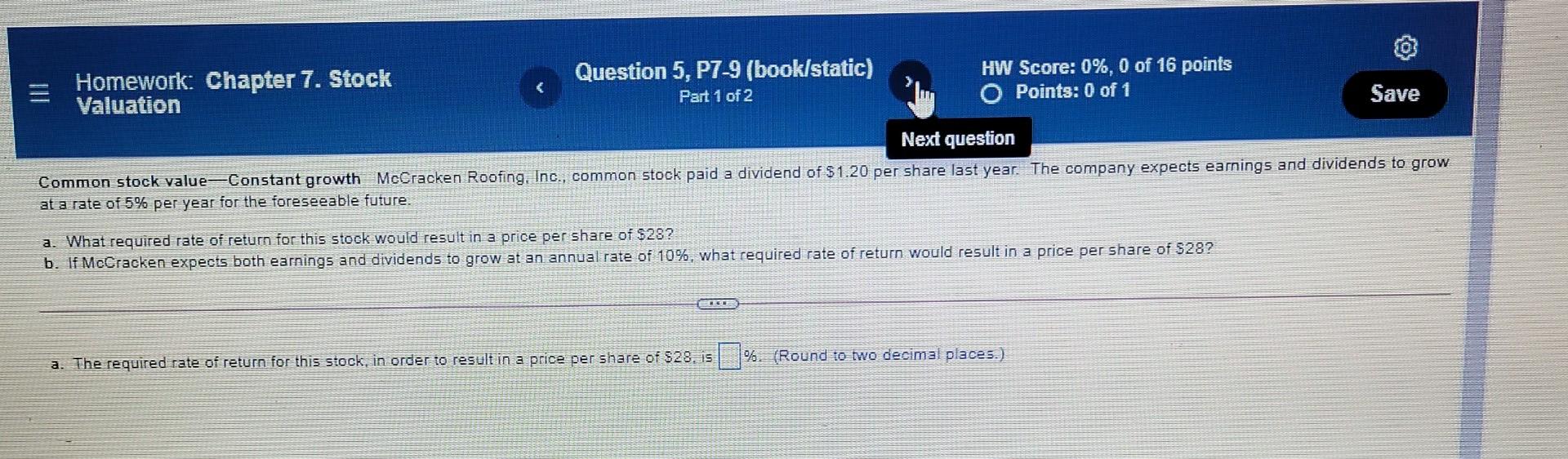

ko Homework: Chapter 7. Stock Question 5, P7-9 (book/static) HW Score: 0%, 0 of 16 points Valuation Part 1 of 2 O Points: 0 of 1 Save Next question Common stock value Constant growth McCracken Roofing, Inc., common stock paid a dividend of $1.20 per share last year. The company expects earnings and dividends to grow at a rate of 5% per year for the foreseeable future. a. What required rate of return for this stock would result in a price per share of $28? b. If McCracken expects both earnings and dividends to grow at an annual rate of 10%, what required rate of return would result in a price per share of $28? % (Round to two decimal places.) a. The required rate of return for this stock, in order to result in a price per share of $28. is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts