Question: Koantz Company manufactures two models of industrial components-a Basic model and an Advanced Model. The compary ponsiders all of its manufacturing overhead costs to be

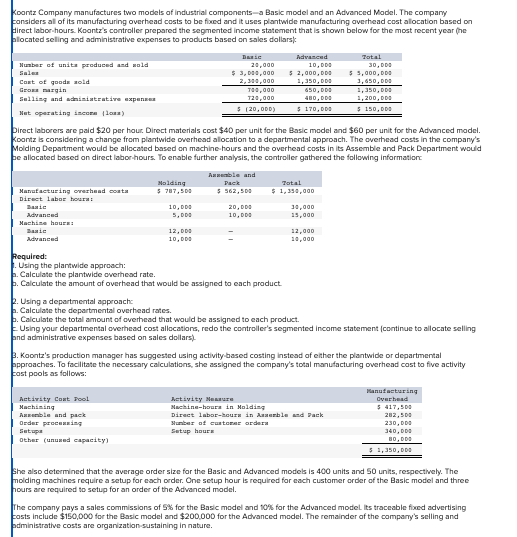

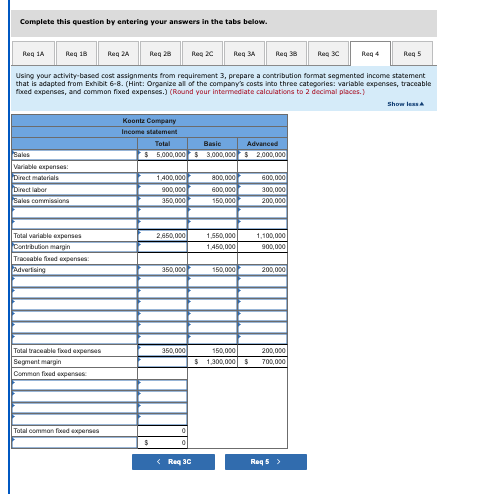

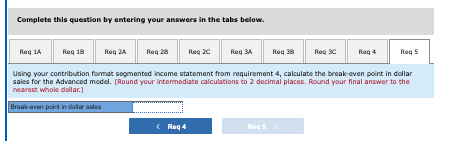

Koantz Company manufactures two models of industrial components-a Basic model and an Advanced Model. The compary ponsiders all of its manufacturing overhead costs to be focd and it uses plantwide manufacturing averhead cost alocation based on Hirect laboe-hours. Koontz's cantrolier prepared the segmented inceme statement that is shown below for the most recent year (he blocated seling and adiministrathve expenses to products based on sales dollarsk: Direct laborers are paid $20 per hour. Direct materials cost $40 per unit for the Basic medel and $60 per unit for the Advanced model. Koontz is considering a change from plantwide werhead alocation to a departmental appeoach. The overhead costs in the company's Molding Department would be allecated based on machine.hours and the overhead cests in its Assemble and Pack Department weuld pe aliocated based on direct labochours. To enable further analysis, the controller gathered the following informationc Pequired: . Using the plantwide approach: . Calculate the plantwide awerhead rate. p. Calculate the ameunt of overhead that would be assigned to each product. 2. Using a departmental approachc . Calculate the departmental overhead rates. 2. Calculate the total amount of averhead that would be assigned to each product. - Using your departmental awerhead cost allocatians, redo the controller's segmented income statement (continue to allocate selling and administrative expenses based on sales dollarsi. 3. Kocntz's preduction manager has suggested using activity based costing instead of either the plantwide or departmertal approaches. To facilitate the necessary calculations, she assigned the company's total manufacturing overhead cost to five activity cost pools as follows: She also determined that the average order size for the Basic and Actuanced models is 400 units and 50 units, respectively. The molding machines require a setup for each order. One sctup hour is required for each customer order of the Basic model and three hours are required to setup for an order of the Advanced model. The company pays a sales commissians of 5% for the Basic medel and tofk for the Advanced model its traceable foed advertising posts include $150,000 for the Basic medel and $200,000 for the Advanecd medel. The remainder of the campary's selling and pdiministrathve costs are organization-sustaining in nature. Complete this question by entering your answers in the tabs below. Using your activity-based cost assignments from requirement 3, prepare a conkribution format segmented income statement that is adapted from Exhibit 6.8. (Hint: Orgarize all of the company's costs into three categories: variable expenses, traceable foced expenses, and common fixed expenses.) (Round your intermediate caloulations to 2 decimal places.) Complete this question by entering your answers in the tabs below. Using your contribution fomat sogmented income statement from requirement 4, calculate the break-even point in dollar bales for the Advanced model. [Round your intermediate calculations to 2 decimal places. Found your final answer to the hearest whok dollar.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts