Question: Konkoto Co. is considering replacing an old Welding machine for a new welding machine with a 12 years life. The new equipment cost $94,000.00

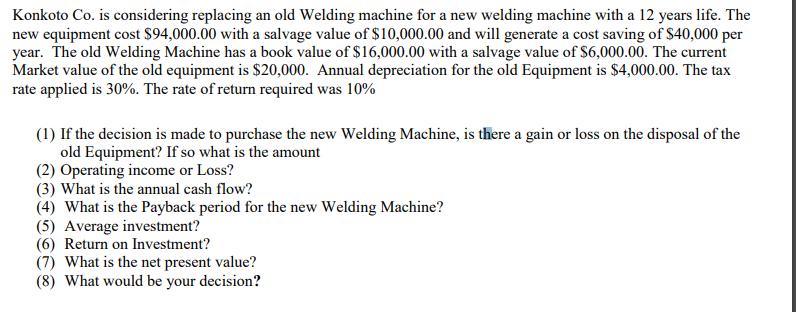

Konkoto Co. is considering replacing an old Welding machine for a new welding machine with a 12 years life. The new equipment cost $94,000.00 with a salvage value of $10,000.00 and will generate a cost saving of $40,000 per year. The old Welding Machine has a book value of $16,000.00 with a salvage value of $6,000.00. The current Market value of the old equipment is $20,000. Annual depreciation for the old Equipment is $4,000.00. The tax rate applied is 30%. The rate of return required was 10% (1) If the decision is made to purchase the new Welding Machine, is there a gain or loss on the disposal of the old Equipment? If so what is the amount (2) Operating income or Loss? (3) What is the annual cash flow? (4) What is the Payback period for the new Welding Machine? (5) Average investment? (6) Return on Investment? (7) What is the net present value? (8) What would be your decision?

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Answer 1 Current Market Value of Old Michine 20000 Less Book Value 16000 Gain 2000... View full answer

Get step-by-step solutions from verified subject matter experts