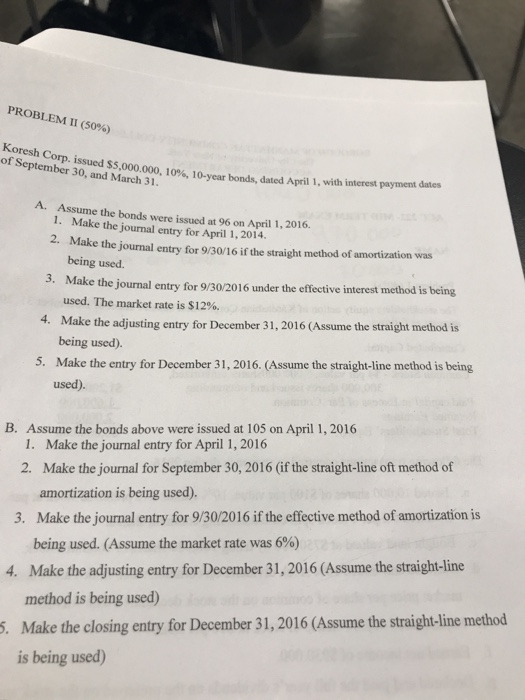

Question: Koresh Corp. issued $5,000.000, 10%, 10-year bonds, dated April 1, with interest payment dates of September 30, and March 31. Assume the bonds were issued

Koresh Corp. issued $5,000.000, 10%, 10-year bonds, dated April 1, with interest payment dates of September 30, and March 31. Assume the bonds were issued at 96 on April 1, 2006 Make the journal entry for April 1, 2014 Make the journal entry for 9/30/16 if the straight method of amortization was being used. Make the journal entry for 9/30/2016 under the effective interest method is being used. The market rate is $12%. Make the adjusting entry for December 31, 2016 (Assume the straight-line method is being used). Assume the bonds above were issued at 105 on April 1, 2016 Make the journal entry for April 1, 2016 2. Make the journal for September 30, 2016 (if the straight-line oft method of amortization is being used). Make the journal entry for 9/30/2016 if the effective method of amortization is being used. (Assume the market rate was 6%) Make the adjusting entry for December 31, 2016 (Assume the straight-line method is being used) Make the closing entry for December 31, 2016 (Assume the straight-line method is being used)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts