Question: Kossan bought a RM1000 par value bond when it has 10 years' maturity left at a price of RM960. The bond pays a 6% annual

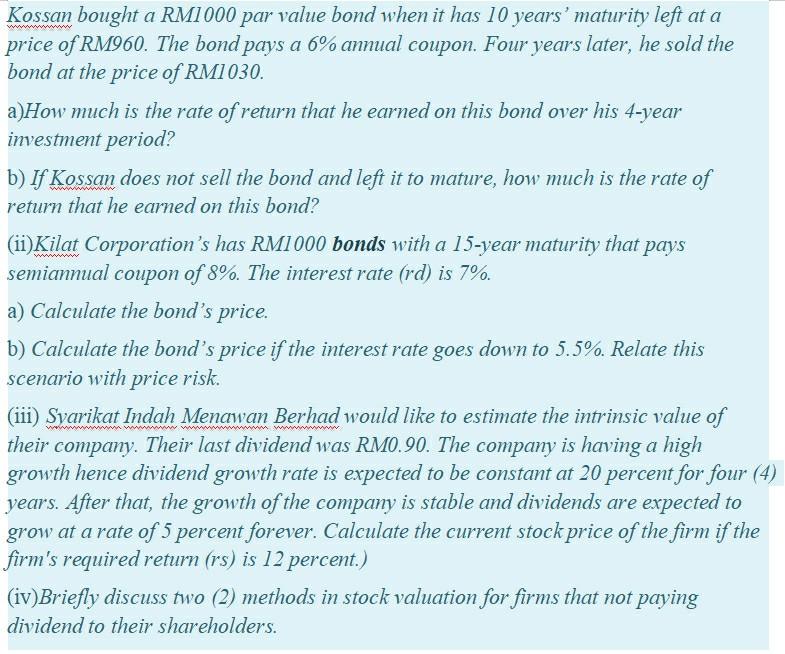

Kossan bought a RM1000 par value bond when it has 10 years' maturity left at a price of RM960. The bond pays a 6% annual coupon. Four years later, he sold the bond at the price of RM1030. a)How much is the rate of return that he earned on this bond over his 4-year investment period? b) If Kossan does not sell the bond and left it to mature, how much is the rate of return that he earned on this bond? (ii)Kilat Corporation's has RM1000 bonds with a 15-year maturity that pays semiannual coupon of 8%. The interest rate (rd) is 7%. a) Calculate the bond's price. b) Calculate the bond's price if the interest rate goes down to 5.5%. Relate this scenario with price risk. (iii) Syarikat Indah Menawan Berhad would like to estimate the intrinsic value of their company. Their last dividend was RM0.90. The company is having a high growth hence dividend growth rate is expected to be constant at 20 percent for four (4) years. After that, the growth of the company is stable and dividends are expected to grow at a rate of 5 percent forever. Calculate the current stock price of the firm if the firm's required return (rs) is 12 percent.) (iv)Briefly discuss two (2) methods in stock valuation for firms that not paying dividend to their shareholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts