Question: Kris earned $ 1 , 6 0 0 . 0 0 during the most recent weekly pay period. Kris is married filing jointly with 2

Kris earned $ during the most recent weekly pay period. Kris is married filing jointly with dependents under the age of per the Form W with no pretax deductions and no additional withholding. Form W Step box has been checked. Using the percentage method, compute Kris's federal income tax for the period.

Note: Use the percentagebracket table. Do not round intermediate calculations. Round final answer to decimal places.

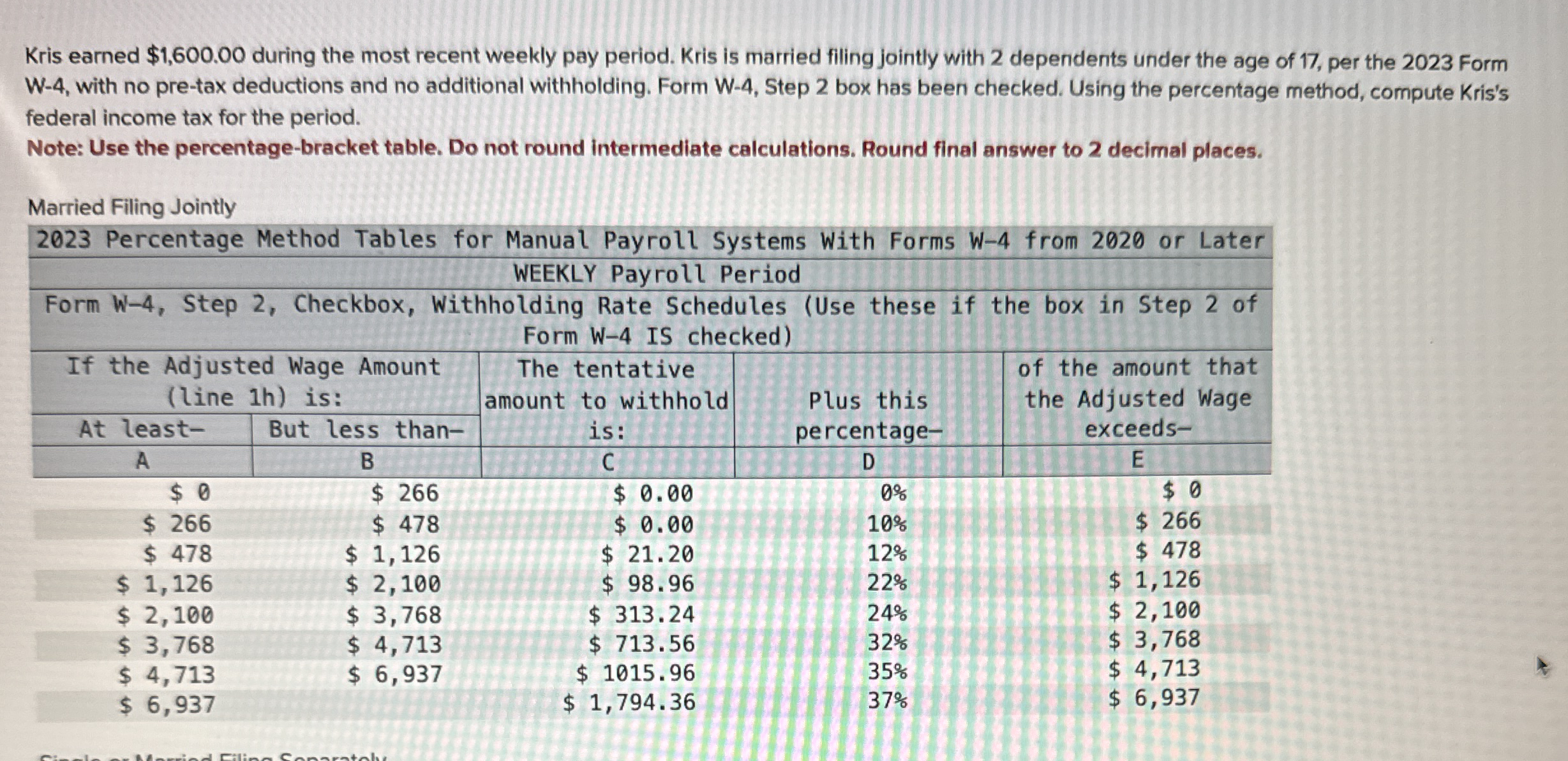

Married Filing Jointly

Percentage Method Tables for Manual Payroll Systems With Forms W from or Later

WEEKLY Payroll Period

Form W Step Checkbox, Withholding Rate Schedules Use these if the box in Step of Form W IS checked

tableIf the Adju lintabled Wage Amounth is:The tentative amount to withhold is:Plus this percentageof the amount that the Adjusted Wage exceedsAt leastBut less thanABCDE$ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock