Question: Kris is a U . S . Citizen filing Married Filing Jointly with her husband Shaun. She provided all of the support of her father

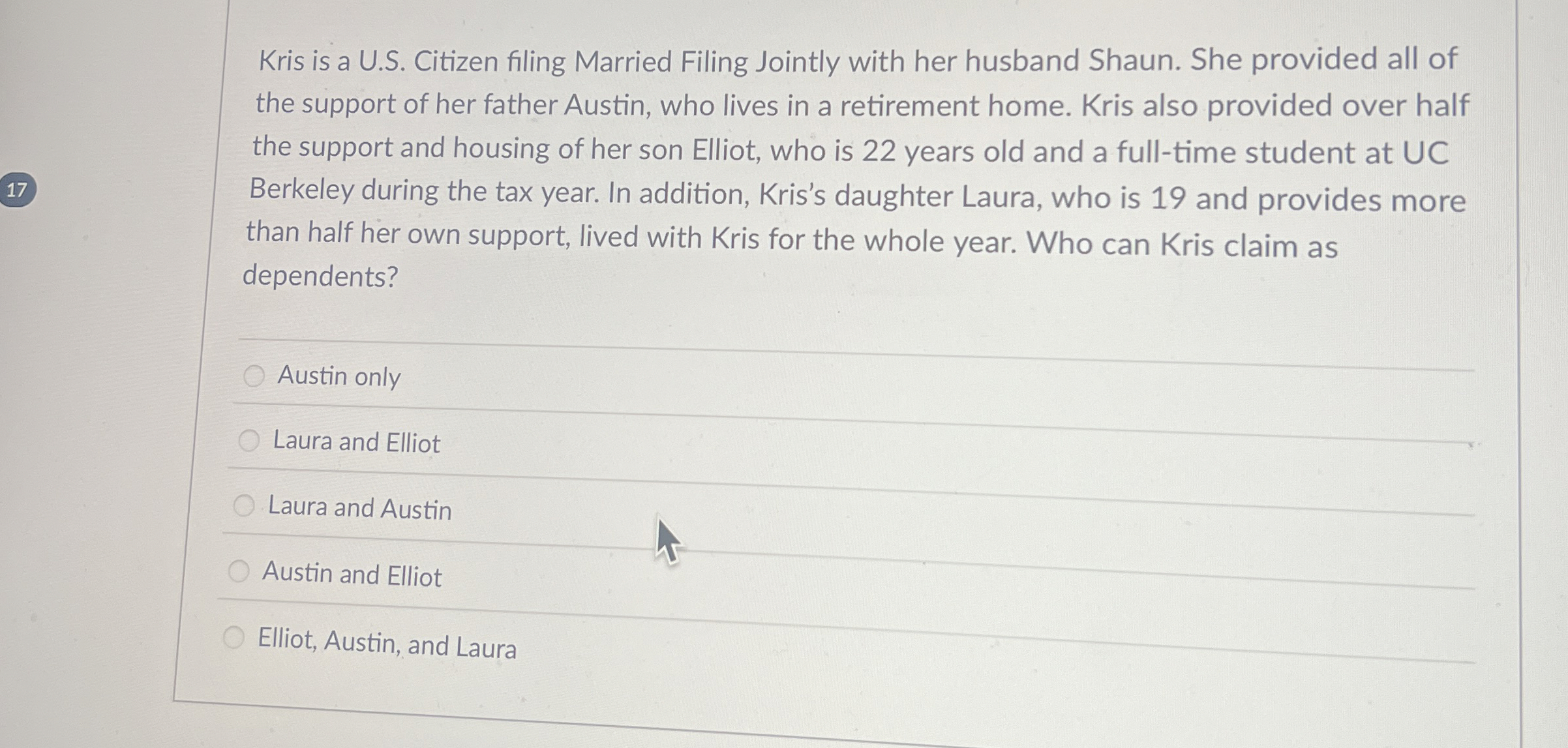

Kris is a US Citizen filing Married Filing Jointly with her husband Shaun. She provided all of the support of her father Austin, who lives in a retirement home. Kris also provided over half the support and housing of her son Elliot, who is years old and a fulltime student at UC Berkeley during the tax year. In addition, Kris's daughter Laura, who is and provides more than half her own support, lived with Kris for the whole year. Who can Kris claim as dependents?

Austin only

Laura and Elliot

Laura and Austin

Austin and Elliot

Elliot, Austin, and Laura

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock