Question: Krispy Kreme Doughnuts (KKD) has a capital structure consisting almost entirely of equity. If the beta of KKD stock equals 1.6, the risk-free rate equals

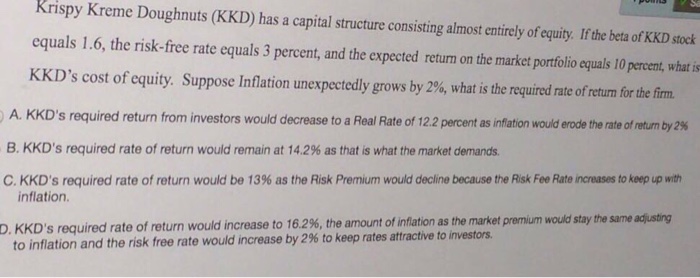

Krispy Kreme Doughnuts (KKD) has a capital structure consisting almost entirely of equity. If the beta of KKD stock equals 1.6, the risk-free rate equals 3 percent, and the expected return on the market portfolio equals 10percent, what is KKD's cost of equity. Suppose Inflation unexpectedly grows by 2%, what is the required rate of return for the firm. A. KKD's required return from investors would decrease to a Real Rate of 12.2 percent as inflation would erode the rate of return by 2% B. KKD's required rate of return would remain at 14.2% as that is what the market demands. C. KKD's required rate of return would be 13% as the Risk Premium would decline because the Risk Fee Rate increases to keep up with inflation. D. KKD's required rate of return would increase to 16.2%, the amount of inflation as the market premium would stay the same adjusting to inflation and the risk free rate would increase by 2% to keep rates attractive to investors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts