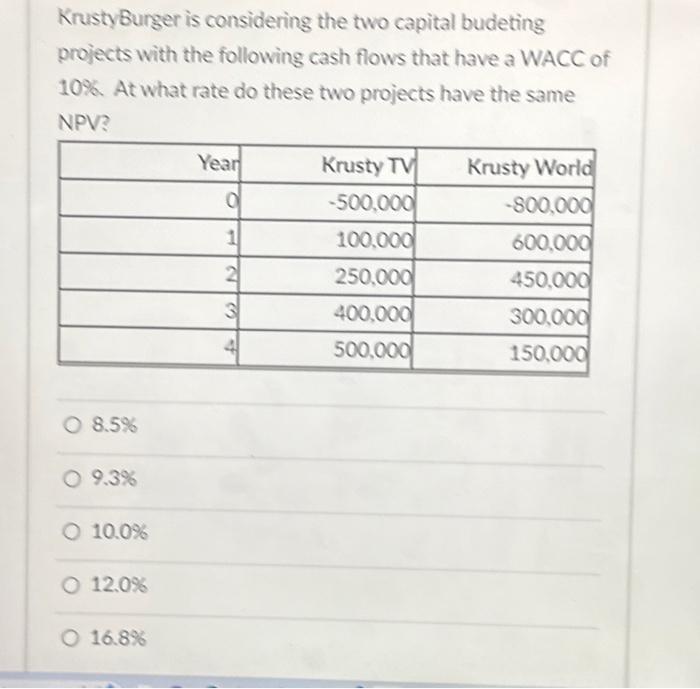

Question: Krusty Burger is considering the two capital budeting projects with the following cash flows that have a WACC of 10%. At what rate do these

Krusty Burger is considering the two capital budeting projects with the following cash flows that have a WACC of 10\%. At what rate do these two projects have the same NPV? \begin{tabular}{|r|r|r|} \hline Year & Krusty TV & Krusty World \\ \hline 0 & 500,000 & 800,000 \\ \hline 1 & 100,000 & 600,000 \\ \hline 2 & 250,000 & 450,000 \\ \hline 3 & 400,000 & 300,000 \\ \hline 4 & 500,000 & 150,000 \\ \hline \end{tabular} 8.5% 9.3% 10.0% 12.0% 16.8%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock