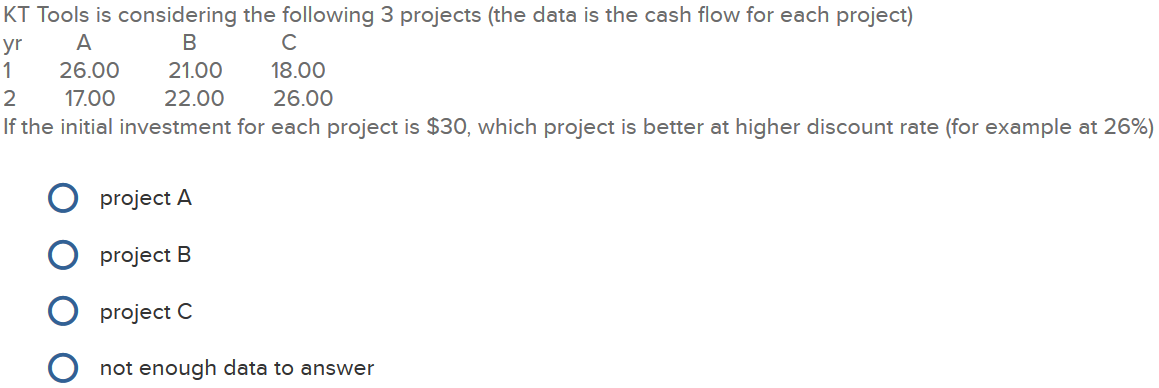

Question: KT Tools is considering the following 3 projects (the data is the cash flow for each project) yr A B 1 26.00 21.00 18.00 2

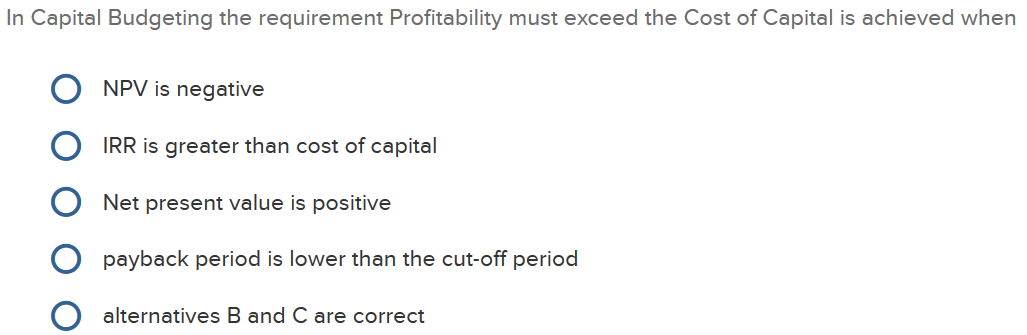

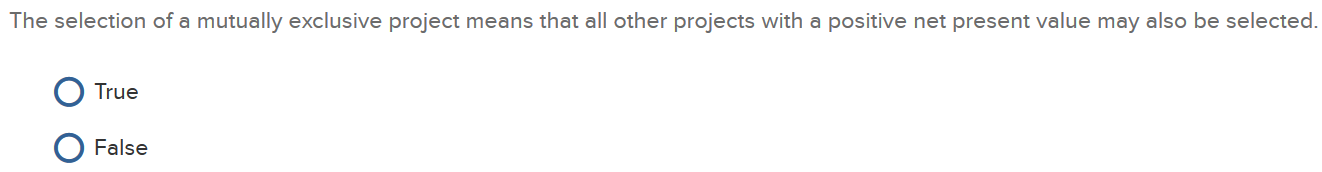

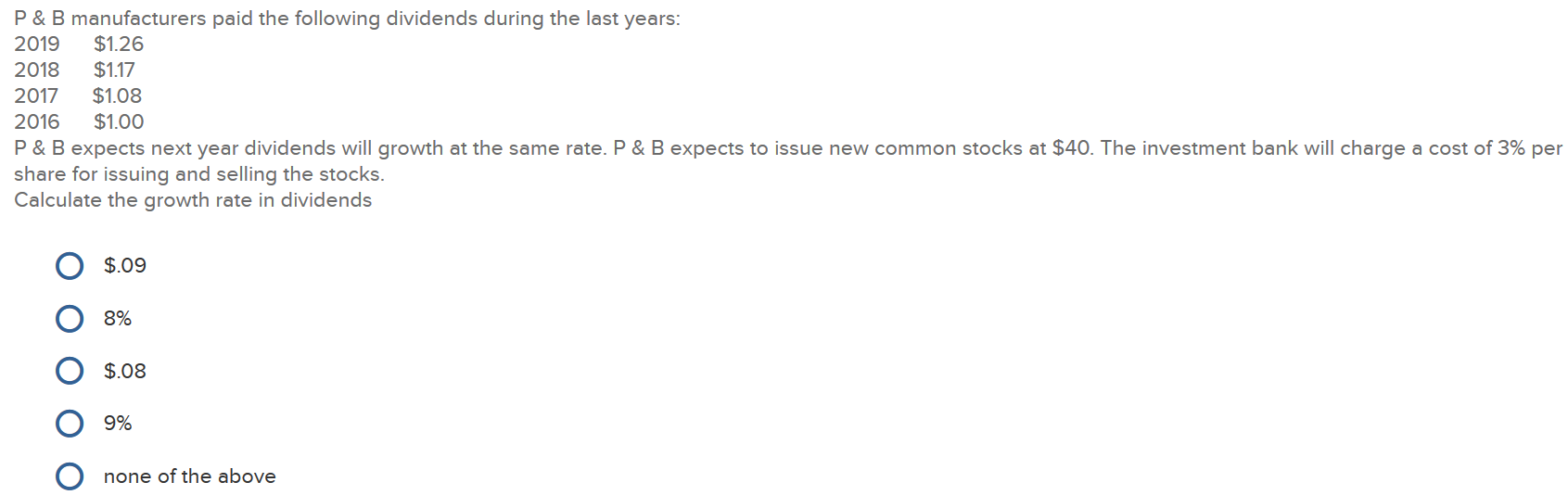

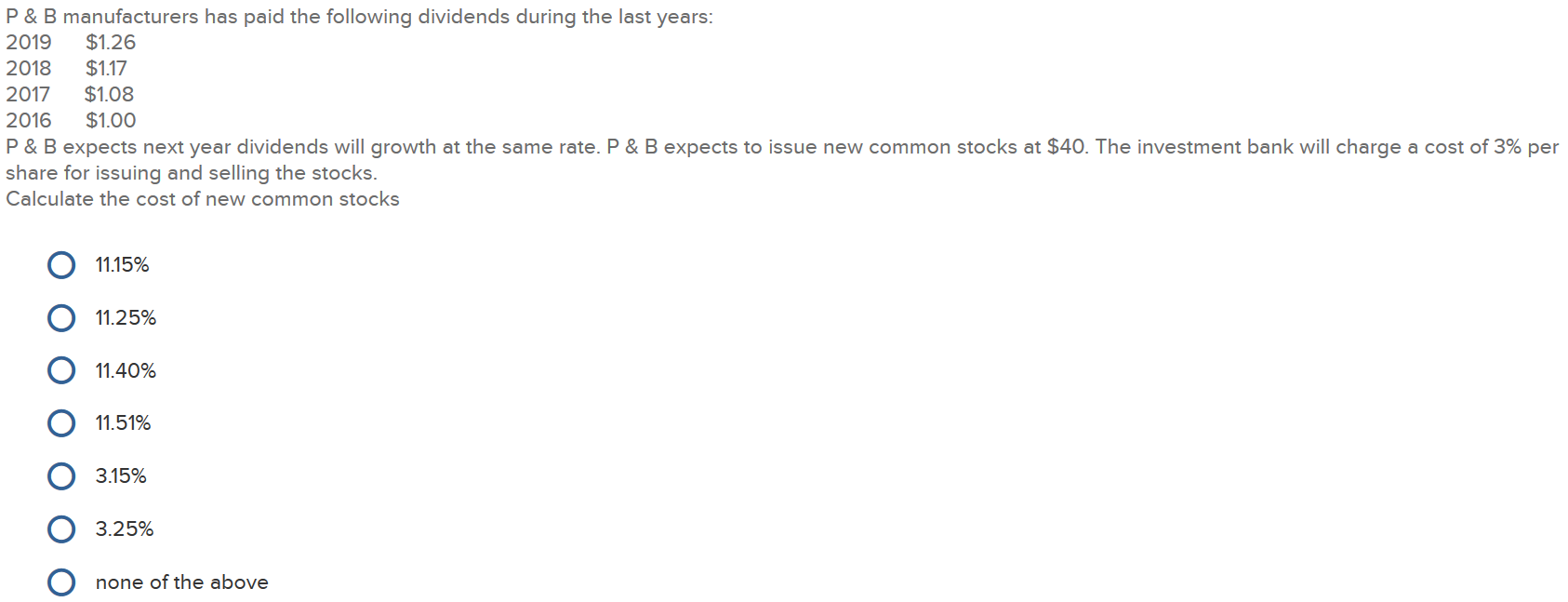

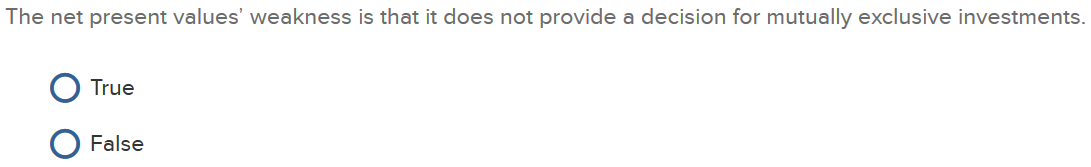

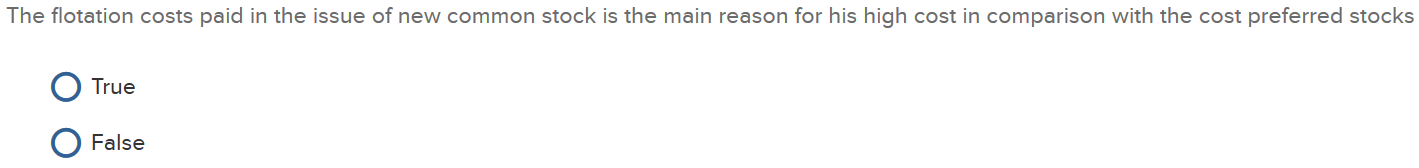

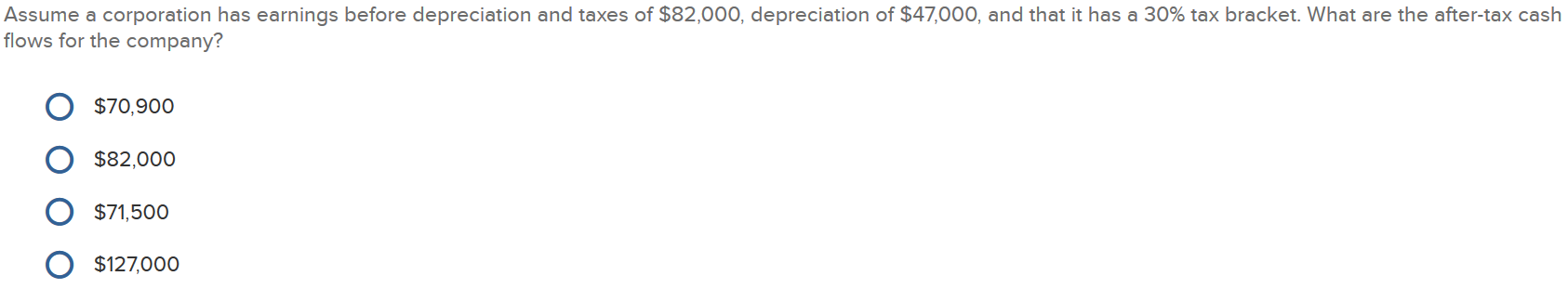

KT Tools is considering the following 3 projects (the data is the cash flow for each project) yr A B 1 26.00 21.00 18.00 2 17.00 22.00 26.00 If the initial investment for each project is $30, which project is better at higher discount rate (for example at 26%) project A project B project C not enough data to answer In Capital Budgeting the requirement Profitability must exceed the Cost of Capital is achieved when NPV is negative IRR is greater than cost of capital Net present value is positive payback period is lower than the cut-off period alternatives B and Care correct The selection of a mutually exclusive project means that all other projects with a positive net present value may also be selected. True False P&B manufacturers paid the following dividends during the last years: 2019 $1.26 2018 $1.17 2017 $1.08 2016 $1.00 P& B expects next year dividends will growth at the same rate. P& B expects to issue new common stocks at $40. The investment bank will charge a cost of 3% per share for issuing and selling the stocks. Calculate the growth rate in dividends $.09 8% $.08 9% none of the above P&B manufacturers has paid the following dividends during the last years: 2019 $1.26 2018 $1.17 2017 $1.08 2016 $1.00 P& B expects next year dividends will growth at the same rate. P& B expects to issue new common stocks at $40. The investment bank will charge a cost of 3% per share for issuing and selling the stocks. Calculate the cost of new common stocks 11.15% 11.25% 11.40% 11.51% 3.15% 3.25% none of the above The net present values' weakness is that it does not provide a decision for mutually exclusive investments. True False The flotation costs paid in the issue of new common stock is the main reason for his high cost in comparison with the cost preferred stocks True O False Assume a corporation has earnings before depreciation and taxes of $82,000, depreciation of $47,000, and that it has a 30% tax bracket. What are the after-tax cash flows for the company? $70,900 $82,000 $71,500 $127,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts