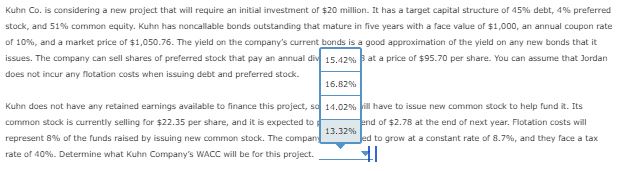

Question: Kuhn Co . is considering a new project that will require an initial irrvestment of $ 2 0 million. It has a target capital structure

Kuhn Co is considering a new project that will require an initial irrvestment of $ million. It has a target capital structure of debt, preferred

stock, and common equity. Kuhn has noncallable bonds outstanding that mature in five years with a face value of $ an annual coupon rate

of and a market price of $ The yield on the company's current bonds is a good approximation of the yield on any new bonds that it

issues. The company can sell shares of preferred stock that pay an annual div

does not incur any fotation costs when issuing debt and preferred stock.

Kuhn does not have any retained earnings available to finance this project, so

common stock is currently selling for $ per share, and it is expected to

represent of the funds raised by issuing new common stock. The company

ill have to issue new common stock to help fund it Its

and of $ at the end of next year. Flotation costs will

rate of Determine what Kuhn Company's WACC will be for this project.

ed to grow at a constant rate of and they face a tax.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock