Question: Kuhn Co. is considering a new project that will require an initial investment of $4 million. It has a target capital structure of 58% debt,

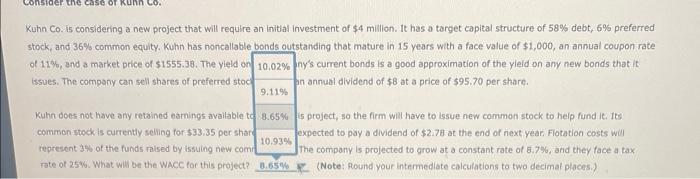

Kuhn Co. is considering a new project that will require an initial investment of $4 million. It has a target capital structure of 58% debt, 6% preferred stock, and 36% common equity. Kuhn has noncallable bonds outstanding that mature in 15 years with a face value of $1,000, an annual coupon rate of 11 th, and a market price of $1555.38. The yield on 10,02% ny's current bonds is a good approximation of the yield on any new bonds that it issues. The company can sell shares of preferred stoc Kuhn does not have any retained eamings avalable to 8.65% is project, so the firm wil have to issue new common stock to help fund it. Its common stockis currently seling for $33.35 per shar 10.93% pexpected to pay a dividend of $2.78 at the end of next year. Flotation costs will represent 3 w of the funds raised by issuing new comr The compony is projected to grow at a constant rate of 8.7%, and they face a tax rote of 25\%. What will bn the WACC for this project? (Note: Pound your intermediate calculations to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts