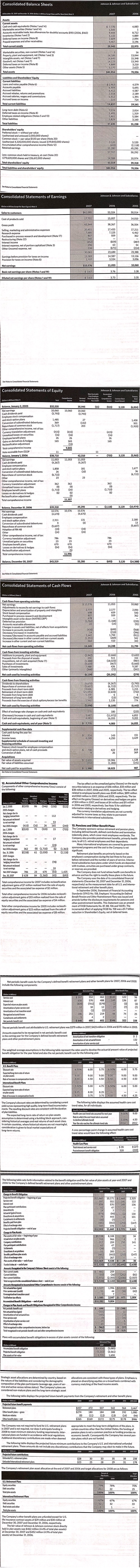

Question: k)Under current U.S. GAAP, Johnson & Johnson includes on its balance sheet the net funded status of its retirement plans. Consider the balance sheet effects

k)Under current U.S. GAAP, Johnson & Johnson includes on its balance sheet the net funded status of its retirement plans. Consider the balance sheet effects of instead including the gross assets of both the retirement plans and the other benefit plans and their respective gross obligations.

i)Use the table below to show how total assets and total liabilities on the balance sheet would be affected.

Retirement and other benefit plan assets

Gross amount that would be added

Net amount currently included

Net amount that would be added

Retirement and other benefit plan liabilities

Gross amount that would be added

Net amount currently included

Net amount that would be added

ii)Determine the amounts and ratios below using Johnson & Johnson's reported numbers. Then, recompute the amounts and ratios on a pro forma basis taking into account the restated assets and liabilities you calculated in part i above. For purposes of these calculations, use year-end balance sheet numbers and assume that the company's marginal tax rate, as approximated by the combined federal and state statutory rates is 35%.

As reported

Total assets

Total liabilities

Liabilities to equity ratio

Return on assets

Return on equity

Proforma

Total assets

Total liabilities

Liabilities to equity ratio

Return on assets

Return on equity

iii)In your opinion, which set of ratios better reflects the economic reality, the as reported or the pro forma ratios? Explain.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts