Question: Kyle, a single taxpayer worked as a freelance software engineer for the first three months of 2021. During that time, he cared $44,000 of self

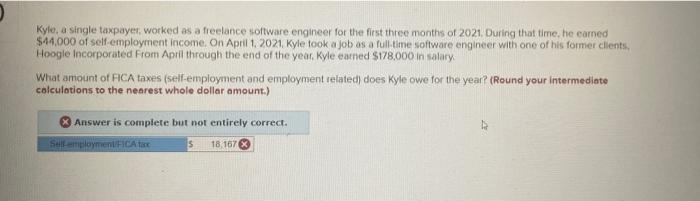

Kyle, a single taxpayer worked as a freelance software engineer for the first three months of 2021. During that time, he cared $44,000 of self employment income. On April 1, 2021. Kyle took a job as a full time software engineer with one of his former clients, Hoogle Incorporated From April through the end of the year Kyle earned $178.000 in salary What amount of FICA taxes (self-employment and employment related) does Kyle owe for the year? (Round your intermediate calculations to the nearest whole dollar amount.) Answer is complete but not entirely correct. Self employmentFICA s 18.107

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts