Question: Kyle Corporation is comparing two different capital structures, aniquity plan (Plan) and a lovered plan (Plan B Under Plan the company would have 765.000 shares

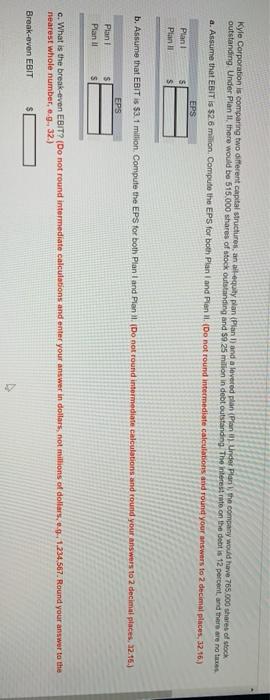

Kyle Corporation is comparing two different capital structures, aniquity plan (Plan) and a lovered plan (Plan B Under Plan the company would have 765.000 shares of stock outstanding Under Plan II, there would be 515.000 shares of stock outstanding and 59 25 million in debt outstanding. The interest rate on the debt is 12 percent and there are no lases a. Assume that EBIT is 52.6 milion Compute the EPS for both Plan and Plant (Do not round intermediate calculations and round your answers to 2 decimal places, 32.16.) EPS Plan Plan b. Assume that EBIT is $3.1 million Compute the EPS for both Plan and Piani. Do not found intermediate calculations and round your answers to 2 decimal places. 12. 16.) EPS Plan Plan il c. What is the break-even EBIT? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars. e... 1.234,567. Round your answer to the nearest whole number, e.g. 32.) Break-even EBIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts