Question: ( L 0 1 0 - 2 , 1 0 - 4 , 1 0 - 5 , 1 0 - 8 ) ( GL

LGL

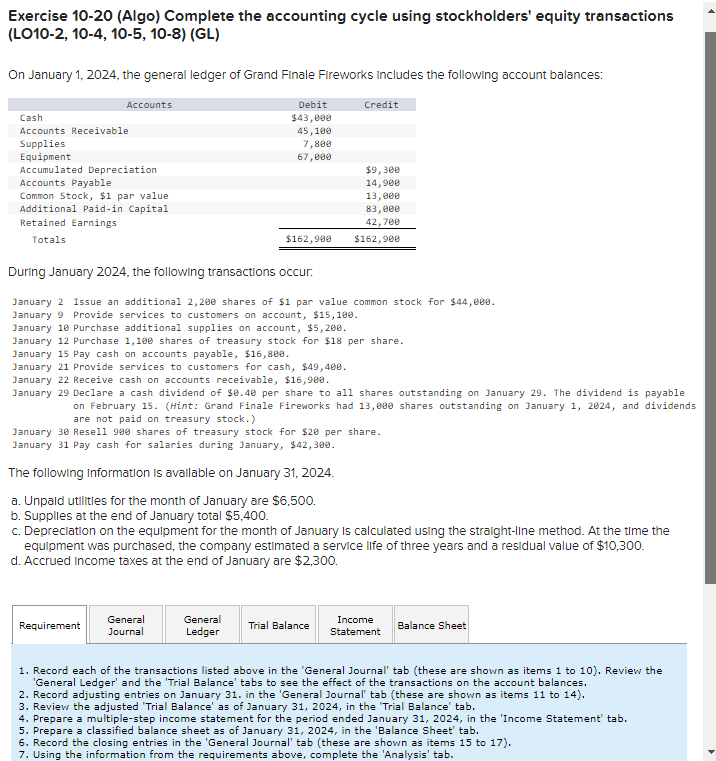

On January the general ledger of Grand Finale Fireworks Includes the following account balances:

During January the following transactions occur:

The following information Is avallable on January

a Unpald utilities for the month of January are $

b Supplies at the end of January total $

c Depreclation on the equipment for the month of January is calculated using the straightIIne method. At the time the

equipment was purchased, the company estimated a service life of three years and a residual value of $

d Accrued income taxes at the end of January are $Required information Exercise Algo Complete the accounting cycle using stockholders' equity transactions LO The following information applies to the questions displayed below On January the general ledget of Grand Finale Fireworks includes the following account balances: During January the following transactions occur: Jwhuary Issue an acditianal e shares of $ par walue conton stock for s eee. January o Provide services to custoners an account, $ et Jahuary Purchase additional supplies on account, $ Jasuary Purchase thares of treasury stock for $ per share. January Bay cash on accounts payable, January Provide services to custoeers for cash, ed January fecelve cash on accounts recelvable, $ January Declare a cash dividend of se per share to all shares outstanding on January The aividend is pwyable on Vebruary wint: Grand finale Firtworks had eee ahares outstanding on January and dividends are not paid on treasury stock. fenuary se fate shares of treesury steck for per share. emuery i Pay cash fo

Record each of the transactions listed above in the 'General Journal' tab these are shown as items to Review the 'General Ledger' and the 'Trial Balance' tabs to see the effect of the transactions on the account balances.

Record adjusting entries on January in the 'General Journal' tab these are shown as items to

Review the adjusted 'Trial Balance' as of January in the 'Trial Balance' tab.

Prepare a multiplestep income statement for the period ended January in the 'Income Statement' tab.

Prepare a classified balance sheet as of January in the 'Balance Sheet' tab.

Record the closing entries in the 'General Journal' tab these are shown as items to

Using the information from the requirements above, complete the 'Analysis' tab.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock