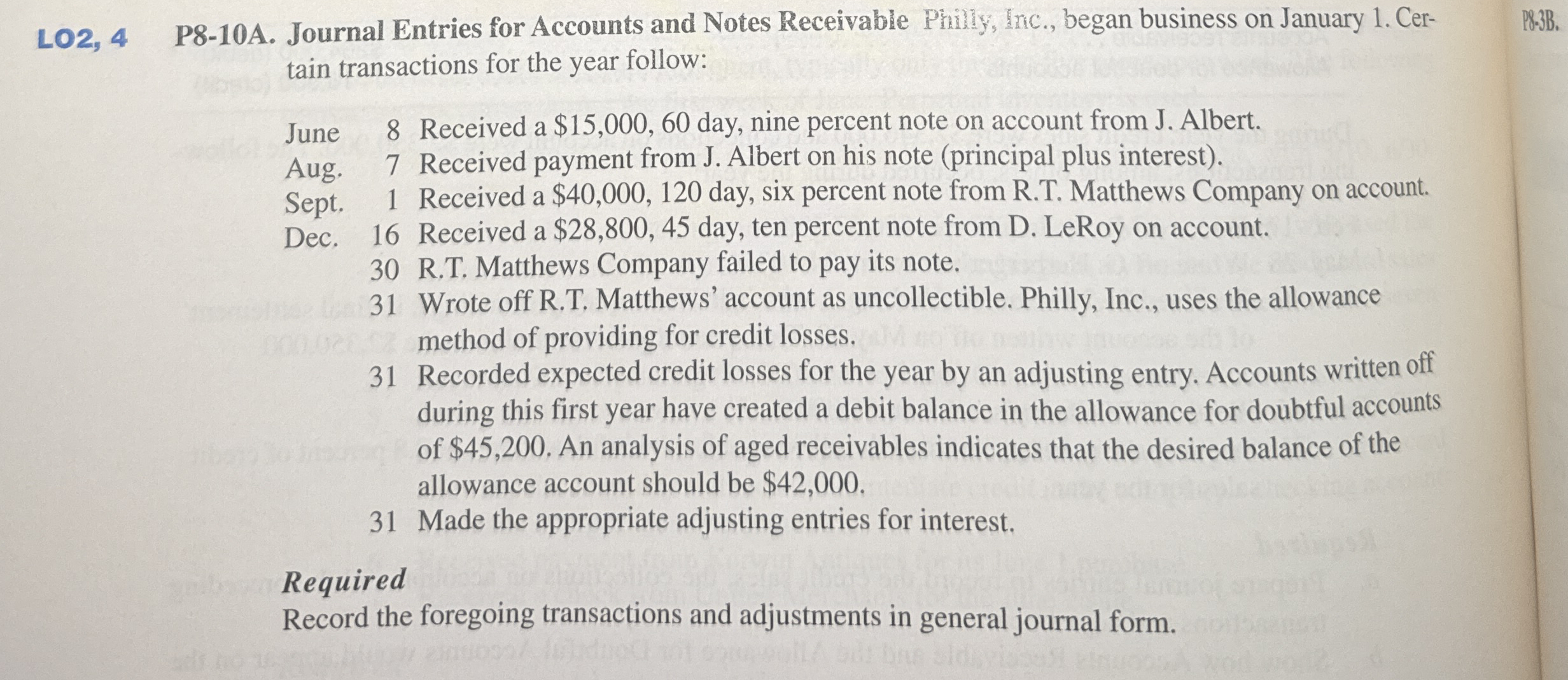

Question: L 0 2 , 4 P 8 - 1 0 A . Journal Entries for Accounts and Notes Receivable Phily, Inc., began business on January

L PA Journal Entries for Accounts and Notes Receivable Phily, Inc., began business on January Certain transactions for the year follow:

June Received a $ day, nine percent note on account from J Albert.

Aug. Received payment from J Albert on his note principal plus interest

Sept. Received a $ day, six percent note from RT Matthews Company on account.

Dec. Received a $ day, ten percent note from D LeRoy on account.

RT Matthews Company failed to pay its note.

Wrote off RT Matthews' account as uncollectible. Philly, Inc., uses the allowance method of providing for credit losses.

Recorded expected credit losses for the year by an adjusting entry. Accounts written off during this first year have created a debit balance in the allowance for doubtful accounts of $ An analysis of aged receivables indicates that the desired balance of the allowance account should be $

Made the appropriate adjusting entries for interest.

Required

Record the foregoing transactions and adjustments in general journal form.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock