Question: l 37. A parent company uses the partial equity method to account for an investment in common stock of its subsidiary. A portion of the

l

l

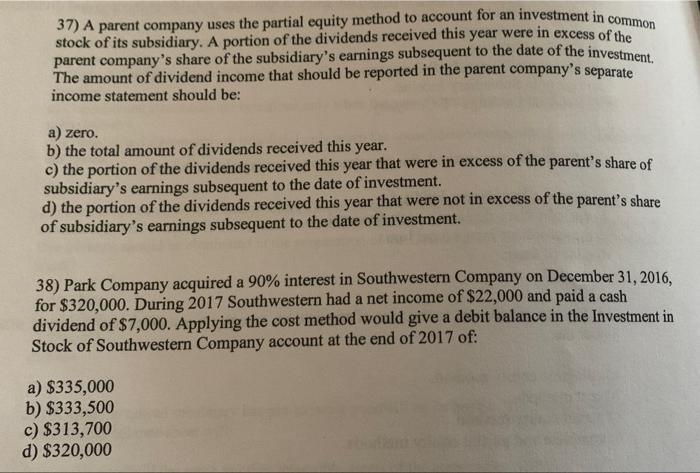

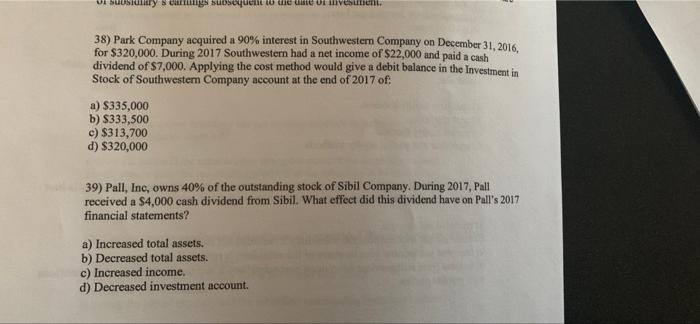

37. A parent company uses the partial equity method to account for an investment in common stock of its subsidiary. A portion of the dividends received this year were in excess of the parent company's share of the subsidiary's earnings subsequent to the date of the investment. The amount of dividend income that should be reported in the parent company's separate income statement should be: a) zero. b) the total amount of dividends received this year. c) the portion of the dividends received this year that were in excess of the parent's share of subsidiary's earnings subsequent to the date of investment. d) the portion of the dividends received this year that were not in excess of the parent's share of subsidiary's earnings subsequent to the date of investment. 38) Park Company acquired a 90% interest in Southwestern Company on December 31, 2016, for $320,000. During 2017 Southwestern had a net income of $22,000 and paid a cash dividend of $7,000. Applying the cost method would give a debit balance in the Investment in Stock of Southwestern Company account at the end of 2017 of: a) $335,000 b) $333,500 c) $313,700 d) $320,000 Visuusly barris subsequent o deste curent 38) Park Company acquired a 90% interest in Southwestern Company on December 31, 2016, for $320,000. During 2017 Southwestern had a net income of $22,000 and paid a cash dividend of $7,000. Applying the cost method would give a debit balance in the Investment in Stock of Southwestern Company account at the end of 2017 of: a) S335,000 b) $333,500 e) $313,700 d) $320,000 39) Pall, Inc, owns 40% of the outstanding stock of Sibil Company. During 2017, Pall received a $4,000 cash dividend from Sibil. What effect did this dividend have on Pall's 2017 financial statements? a) Increased total assets. b) Decreased total assets. c) Increased income. d) Decreased investment account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts