Question: L 7 B D E G H 1 K Boston Investment Group (BIG) is considering investing in a commercial office building in Waltham. Your firm

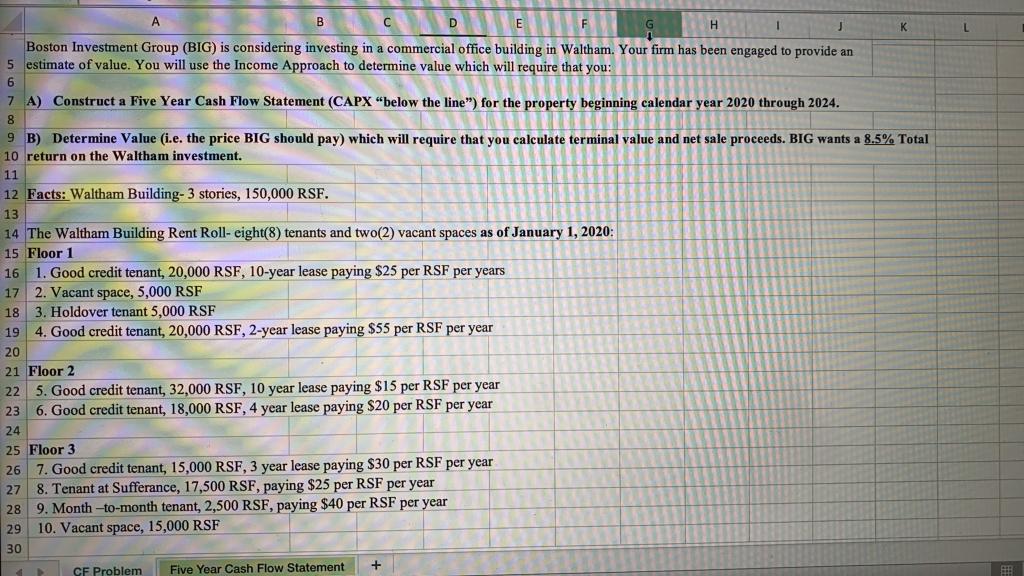

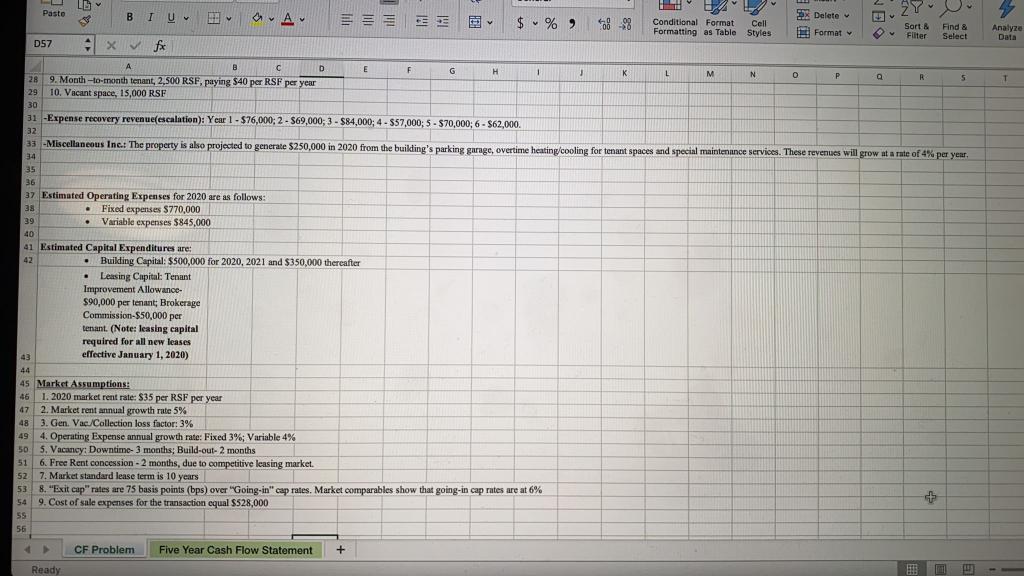

L 7 B D E G H 1 K Boston Investment Group (BIG) is considering investing in a commercial office building in Waltham. Your firm has been engaged to provide an 5 estimate of value. You will use the Income Approach to determine value which will require that you: 6 A) Construct a Five Year Cash Flow Statement (CAPX "below the line") for the property beginning calendar year 2020 through 2024. 8 9 B) Determine Value (i.e. the price BIG should pay) which will require that you calculate terminal value and net sale proceeds. BIG wants a 8.5% Total 10 return on the Waltham investment. 11 12 Facts: Waltham Building- 3 stories, 150,000 RSF. 13 14 The Waltham Building Rent Roll-eight(8) tenants and two(2) vacant spaces as of January 1, 2020: 15 Floor 1 16 1. Good credit tenant, 20,000 RSF, 10-year lease paying $25 per RSF per years 17 2. Vacant space, 5,000 RSF 18 3. Holdover tenant 5,000 RSF 19 4. Good credit tenant, 20,000 RSF, 2-year lease paying $55 per RSF per year 20 21 Floor 2 22 5. Good credit tenant, 32,000 RSF, 10 year lease paying $15 per RSF per year 23 6. Good credit tenant, 18,000 RSF, 4 year lease paying $20 per RSF per year 24 25 Floor 3 26 7. Good credit tenant, 15,000 RSF, 3 year lease paying $30 per RSF per year 27 8. Tenant at Sufferance, 17,500 RSF, paying $25 per RSF per year 28 9. Month-to-month tenant, 2,500 RSF, paying $40 per RSF per year 29 10. Vacant space, 15,000 RSF 30 CF Problem Five Year Cash Flow Statement + V A DZY V Analyze Data A L 0 1 T LG Pasto * Dx Delete IU SE $% 8-98 Conditional Format Cell Sort & Find & Formatting as Table Styles Format Filter Select D57 x Vife B D E F G H 1 3 K 4 M N R 5 28 9. Month-to-month tenant, 2.500 RSF, paying $40 per RSF per year 29 10. Vacant space, 15,000 RSF 30 31 -Expense recovery revenue(escalation): Year 1-576,000: 2 - $69,000; 3 - $84,000; 4 - 557,000; 5 - $70,000; 6 - $62,000. 32 33 -Miscellaneous Inc.: The property is also projected to generate $250,000 in 2020 from the buikling's parking garage, overtime heating/cooling for tenant spaces and special maintenance services. These revenues will grow at a rate of 4% per year. 34 35 . 37 Estimated Operating Expenses for 2020 are as follows: 38 Fixed expenses $770,000 39 Variable expenses $845,000 40 41 Estimated Capital Expenditures are: 42 Building Capital: $500,000 for 2020, 2021 and $350,000 thereafter Leasing Capital: Tenant Improvement Allowance- $90,000 per tenant Brokerage Commission-$50,000 per tenant. (Note: leasing capital required for all new leases 43 effective January 1, 2020) 44 45 Market Assumptions: 46 1. 2020 market rent rate: $35 per RSF per year 47 2. Market rent annual growth rate 5% 48 3. Gen. Vac./Collection loss factor: 3% 49 4. Operating Expense annual growth rate: Fixed 3%;Variable 4% 50 5. Vacancy: Downtime- 3 months: Build-out- 2 months 51 6. Fre 6. Free Rent concession - 2 months, due to competitive leasing market. 52 7. Market standard lease term is 10 years 53 8. "Exit cap" rates are 75 basis points (bps) over "Going-in" cap rates. Market comparables show that going-in cap rates are at 6% 54 9. Cost of sale expenses for the transaction equal $528,000 55 56 CF Problem Five Year Cash Flow Statement + Ready L 7 B D E G H 1 K Boston Investment Group (BIG) is considering investing in a commercial office building in Waltham. Your firm has been engaged to provide an 5 estimate of value. You will use the Income Approach to determine value which will require that you: 6 A) Construct a Five Year Cash Flow Statement (CAPX "below the line") for the property beginning calendar year 2020 through 2024. 8 9 B) Determine Value (i.e. the price BIG should pay) which will require that you calculate terminal value and net sale proceeds. BIG wants a 8.5% Total 10 return on the Waltham investment. 11 12 Facts: Waltham Building- 3 stories, 150,000 RSF. 13 14 The Waltham Building Rent Roll-eight(8) tenants and two(2) vacant spaces as of January 1, 2020: 15 Floor 1 16 1. Good credit tenant, 20,000 RSF, 10-year lease paying $25 per RSF per years 17 2. Vacant space, 5,000 RSF 18 3. Holdover tenant 5,000 RSF 19 4. Good credit tenant, 20,000 RSF, 2-year lease paying $55 per RSF per year 20 21 Floor 2 22 5. Good credit tenant, 32,000 RSF, 10 year lease paying $15 per RSF per year 23 6. Good credit tenant, 18,000 RSF, 4 year lease paying $20 per RSF per year 24 25 Floor 3 26 7. Good credit tenant, 15,000 RSF, 3 year lease paying $30 per RSF per year 27 8. Tenant at Sufferance, 17,500 RSF, paying $25 per RSF per year 28 9. Month-to-month tenant, 2,500 RSF, paying $40 per RSF per year 29 10. Vacant space, 15,000 RSF 30 CF Problem Five Year Cash Flow Statement + V A DZY V Analyze Data A L 0 1 T LG Pasto * Dx Delete IU SE $% 8-98 Conditional Format Cell Sort & Find & Formatting as Table Styles Format Filter Select D57 x Vife B D E F G H 1 3 K 4 M N R 5 28 9. Month-to-month tenant, 2.500 RSF, paying $40 per RSF per year 29 10. Vacant space, 15,000 RSF 30 31 -Expense recovery revenue(escalation): Year 1-576,000: 2 - $69,000; 3 - $84,000; 4 - 557,000; 5 - $70,000; 6 - $62,000. 32 33 -Miscellaneous Inc.: The property is also projected to generate $250,000 in 2020 from the buikling's parking garage, overtime heating/cooling for tenant spaces and special maintenance services. These revenues will grow at a rate of 4% per year. 34 35 . 37 Estimated Operating Expenses for 2020 are as follows: 38 Fixed expenses $770,000 39 Variable expenses $845,000 40 41 Estimated Capital Expenditures are: 42 Building Capital: $500,000 for 2020, 2021 and $350,000 thereafter Leasing Capital: Tenant Improvement Allowance- $90,000 per tenant Brokerage Commission-$50,000 per tenant. (Note: leasing capital required for all new leases 43 effective January 1, 2020) 44 45 Market Assumptions: 46 1. 2020 market rent rate: $35 per RSF per year 47 2. Market rent annual growth rate 5% 48 3. Gen. Vac./Collection loss factor: 3% 49 4. Operating Expense annual growth rate: Fixed 3%;Variable 4% 50 5. Vacancy: Downtime- 3 months: Build-out- 2 months 51 6. Fre 6. Free Rent concession - 2 months, due to competitive leasing market. 52 7. Market standard lease term is 10 years 53 8. "Exit cap" rates are 75 basis points (bps) over "Going-in" cap rates. Market comparables show that going-in cap rates are at 6% 54 9. Cost of sale expenses for the transaction equal $528,000 55 56 CF Problem Five Year Cash Flow Statement + Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts