Question: l A convenience store owner is contemplating putting a large neon sign over his store. It would cost $50,000, but is expected to bring an

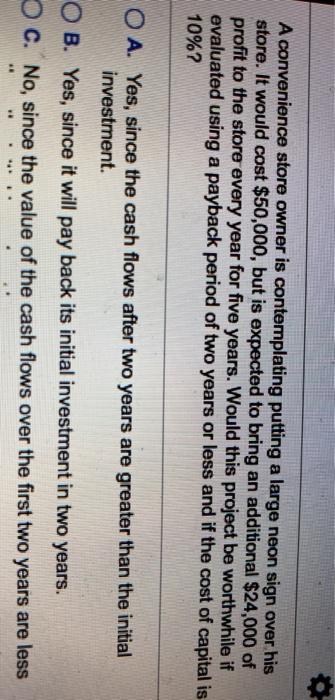

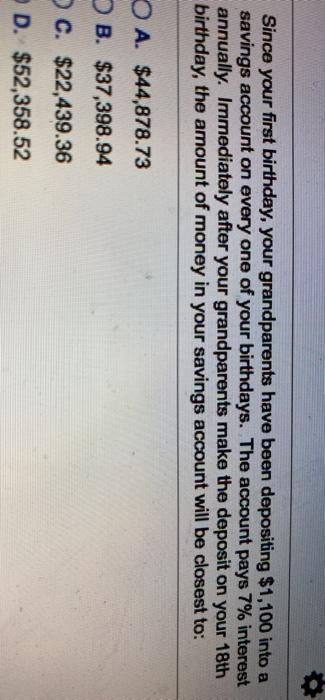

A convenience store owner is contemplating putting a large neon sign over his store. It would cost $50,000, but is expected to bring an additional $24,000 of profit to the store every year for five years. Would this project be worthwhile if evaluated using a payback period of two years or less and if the cost of capital is 10%? O A. Yes, since the cash flows after two years are greater than the initial investment. O B. Yes, since it will pay back its initial investment in two years. O c. No, since the value of the cash flows over the first two years are less Since your first birthday, your grandparents have been depositing $1,100 into a savings account on every one of your birthdays. The account pays 7% interest annually. Immediately after your grandparents make the deposit on your 18th birthday, the amount of money in your savings account will be closest to: O A. $44,878.73 B. $37,398.94 C. $22,439.36 D. $52,358.52

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts