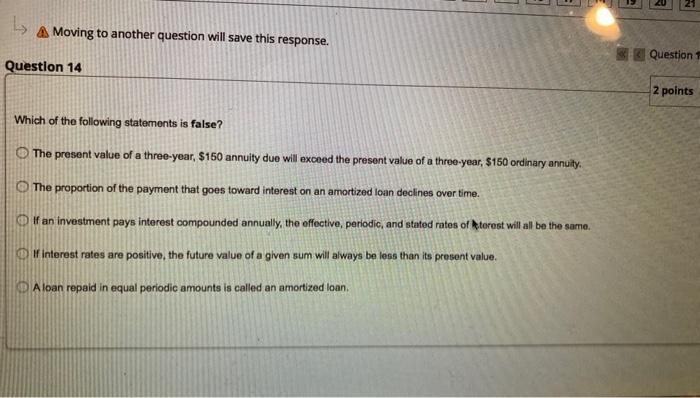

Question: L A Moving to another question will save this response. Question 1 Question 14 2 points Which of the following statements is false? The present

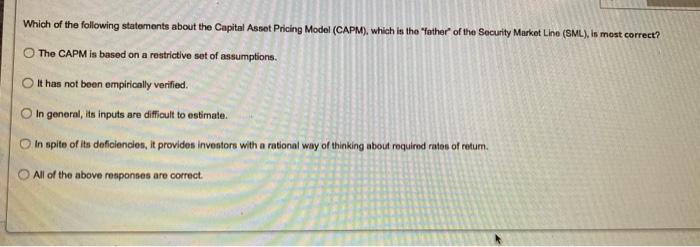

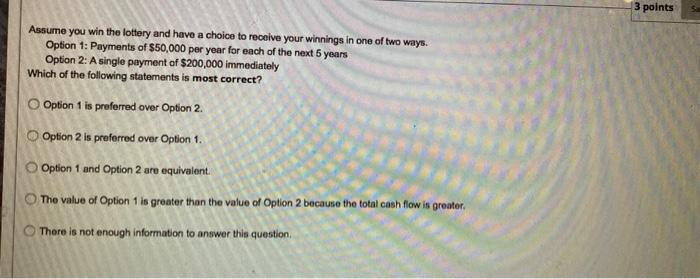

L A Moving to another question will save this response. Question 1 Question 14 2 points Which of the following statements is false? The present value of a three-year, $150 annuity due will exceed the present value of a three-year, $150 ordinary annuity. The proportion of the payment that goes toward interest on an amortized loan declines over time. 0 If an investment pays interest compounded annually, the effective, periodic, and stated rates of terest will all be the same. interest rates are positive, the future value of a given sum will always be less than its present value. e e A loan repaid in equal periodic amounts is called an amortized loan. Which of the following statements about the Capital Asset Pricing Model (CAPM), which is the father of the Security Market Line (SML), Is most correct? The CAPM is based on a restrictive set of assumptions. It has not been empirically verified. In general, its inputs are difficult to estimate. In spite of its deficiencies, it provides inventore with a rational way of thinking about required rates of retum. All of the above responses are correct 3 points Assume you win the lottery and have a choice to receive your winnings in one of two ways. Option 1: Payments of $50,000 per year for each of the next 5 years Option 2: A single payment of $200,000 immediately Which of the following statements is most correct? Option 1 is preferred over Option 2. Option 2 is preferred over Option 1. Option 1 and Option 2 are equivalent. The value of Option 1 is greater than the value of Option 2 because the total cash flow is greater There is not enough information to answer this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts