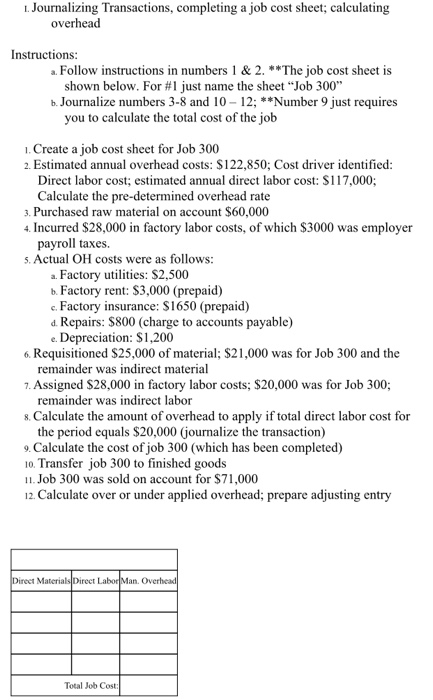

Question: L. Journalizing Transactions, completinga job cost sheet; calculating overhead Instructions a. Follow instructions in numbers 1 & 2. **The job cost sheet is shown below.

L. Journalizing Transactions, completinga job cost sheet; calculating overhead Instructions a. Follow instructions in numbers 1 & 2. **The job cost sheet is shown below. For #1 just name the sheet "Job 300" b. Journalize numbers 3-8 and 10 12;**Number 9 just requires you to calculate the total cost of the job 1. Create a job cost sheet for Job 300 2. Estimated annual overhead costs: $122,850; Cost driver identified: Direct labor cost; estimated annual direct labor cost: $117,000; Calculate the pre-determined overhead rate 3. Purchased raw material on account $60,000 Incurred $28,000 in factory labor costs, of which $3000 was employer payroll taxes S.Actual OH costs were as follows: a. Factory utilities: $2,500 b.Factory rent: $3,000 (prepaid) c. Factory insurance: S1650 (prepaid) Repairs: $800 (charge to accounts payable) Depreciation: $1,200 Requisitioned $25,000 of material; $21,000 4 d was for Job 300 and the 6 remainder was indirect material Assigned $28,000 in factory labor costs; $20,000 was for Job 300; remainder was indirect labor 7 . Calculate the amount of overhead too apply if total direct labor cost for the period equals $20,000 (journalize the transaction) 9. Calculate the cost of job 300 (which has been completed) 10. Transfer job 300 to finished goods 1.Job 300 was sold on account for $71,000 12. Calculate over or under applied overhead; prepare adjusting entry Direct Materials Direct Labor Man. Overhead Total Joh Cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts