Question: L M N P Q R S T U Chapter 4 Problem 1 On January 1, 2020, John Doe Enterprises (JDE) acquired a 55%

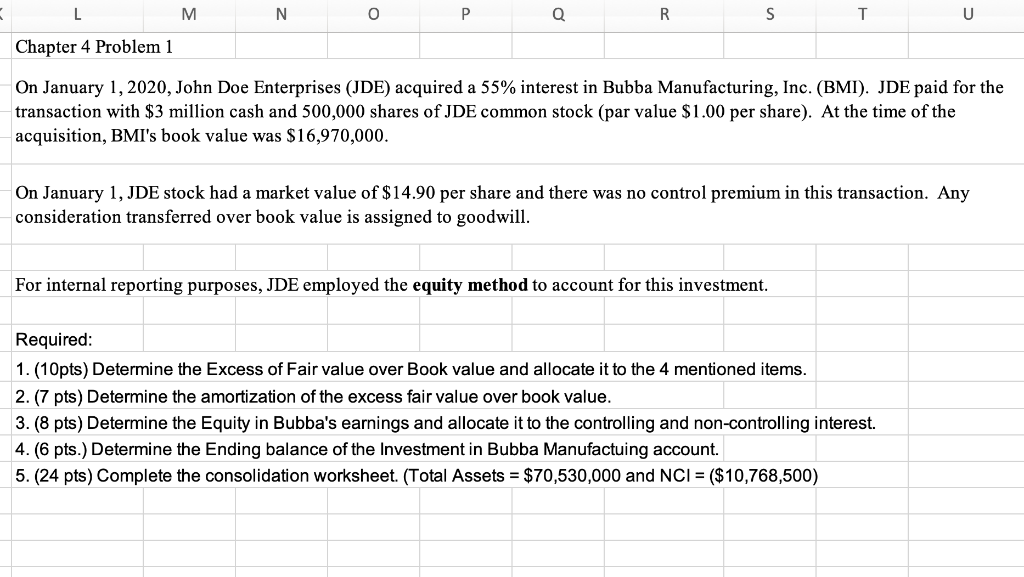

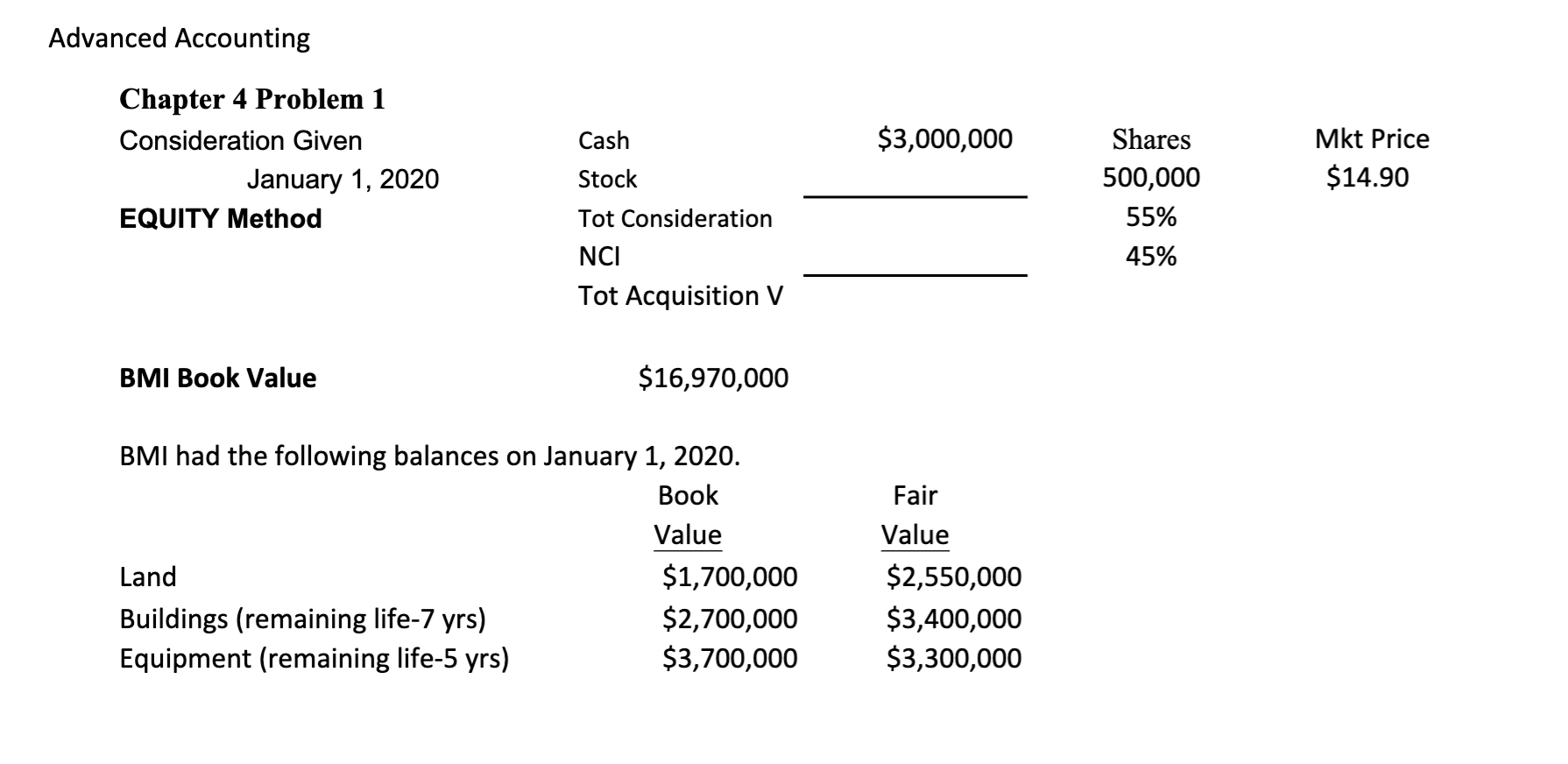

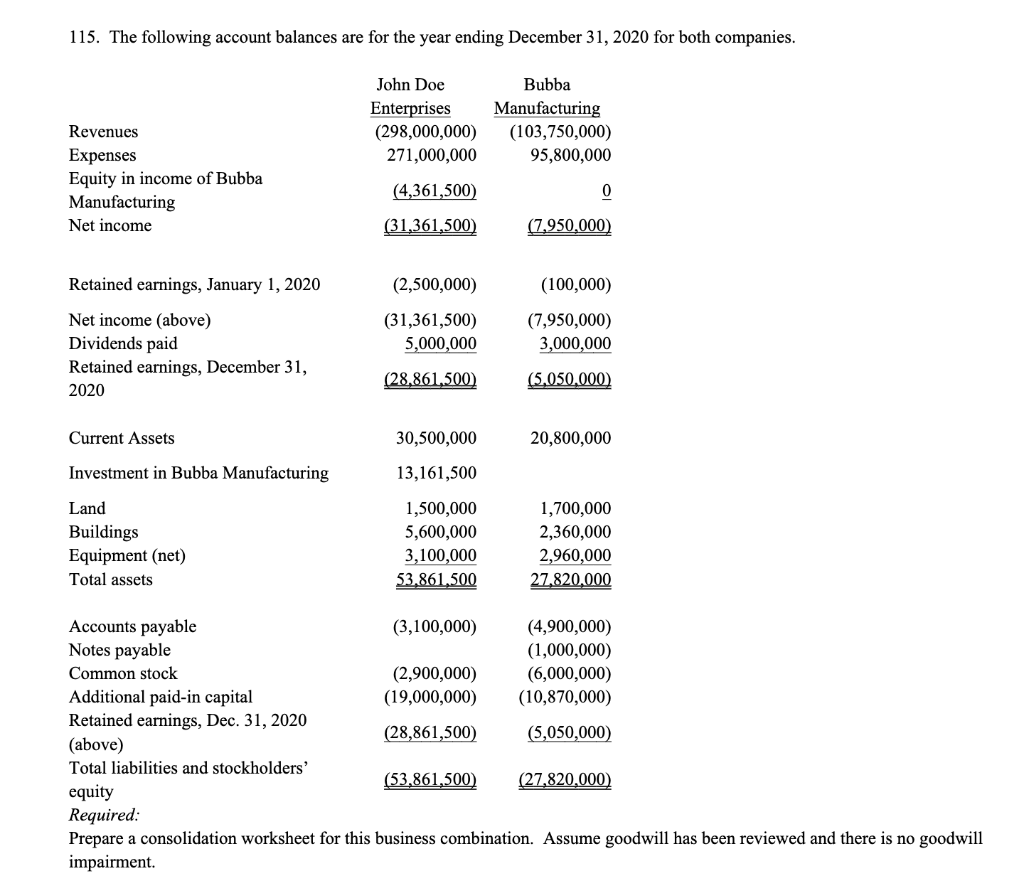

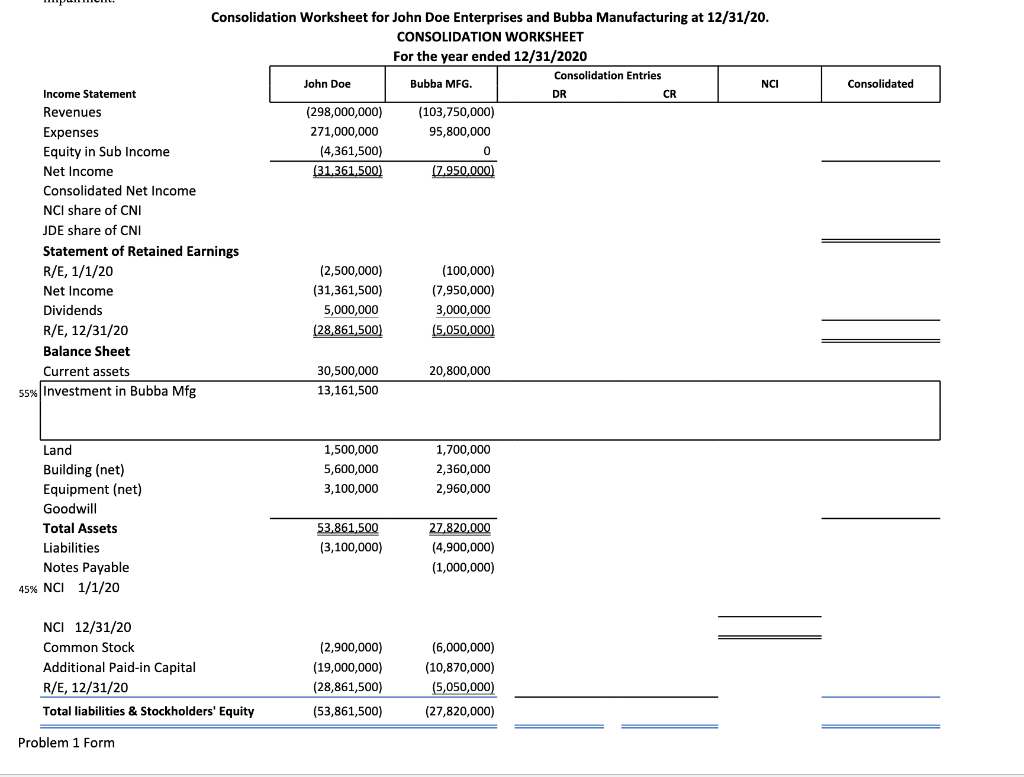

L M N P Q R S T U Chapter 4 Problem 1 On January 1, 2020, John Doe Enterprises (JDE) acquired a 55% interest in Bubba Manufacturing, Inc. (BMI). JDE paid for the transaction with $3 million cash and 500,000 shares of JDE common stock (par value $1.00 per share). At the time of the acquisition, BMI's book value was $16,970,000. On January 1, JDE stock had a market value of $14.90 per share and there was no control premium in this transaction. Any consideration transferred over book value is assigned to goodwill. For internal reporting purposes, JDE employed the equity method to account for this investment. Required: 1. (10pts) Determine the Excess of Fair value over Book value and allocate it to the 4 mentioned items. 2. (7 pts) Determine the amortization of the excess fair value over book value. 3. (8 pts) Determine the Equity in Bubba's earnings and allocate it to the controlling and non-controlling interest. 4. (6 pts.) Determine the Ending balance of the Investment in Bubba Manufactuing account. 5. (24 pts) Complete the consolidation worksheet. (Total Assets = $70,530,000 and NCI = ($10,768,500)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts