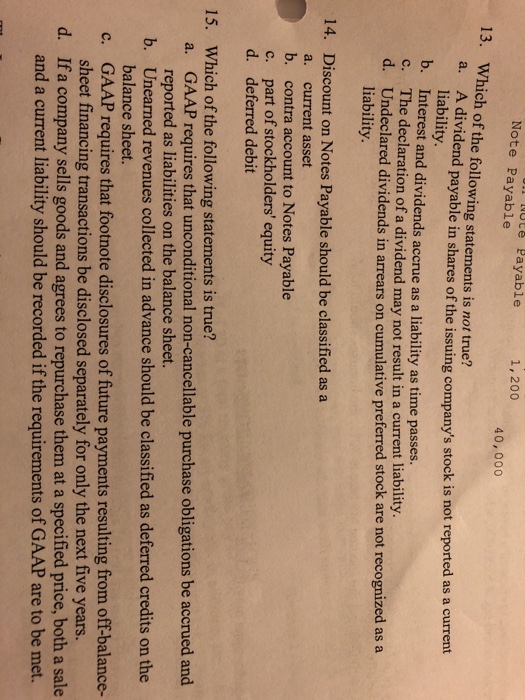

Question: l nute Payable Note Payable 1 1,200 40,000 13. Which of the following statements is not true? a. A divi dend payable in shares of

l nute Payable Note Payable 1 1,200 40,000 13. Which of the following statements is not true? a. A divi dend payable in shares of the issuing company's stock is not reported as a current liability b. Interest and dividends accrue as a liability as time passes. c. Th d. U e declaration of a dividend may not result in a current liability ndeclared dividends in arrears on cumulative preferred stock are not recognized as a liability 14. Discount on Notes Payable should be classified as a a. current asset b. contra account to Notes Payable part of stockholders' equity c. d. deferred debit 15. Which of the following statements is true? a. GAAP requires that unconditional non-cancellable purchase obligations be accrued and b. Unearned revenues collected in advance should be classified as deferred credits on the c. GAAP requires that footnote disclosures of future payments resulting from off-balance- d. If a company sells goods and agrees to repurchase them at a specified price, both a sale reported as liabilities on the balance sheet. balance sheet. sheet financing transactions be disclosed separately for only the next five years. and a current liability should be recorded if the requirements of GAAP are to be met

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts