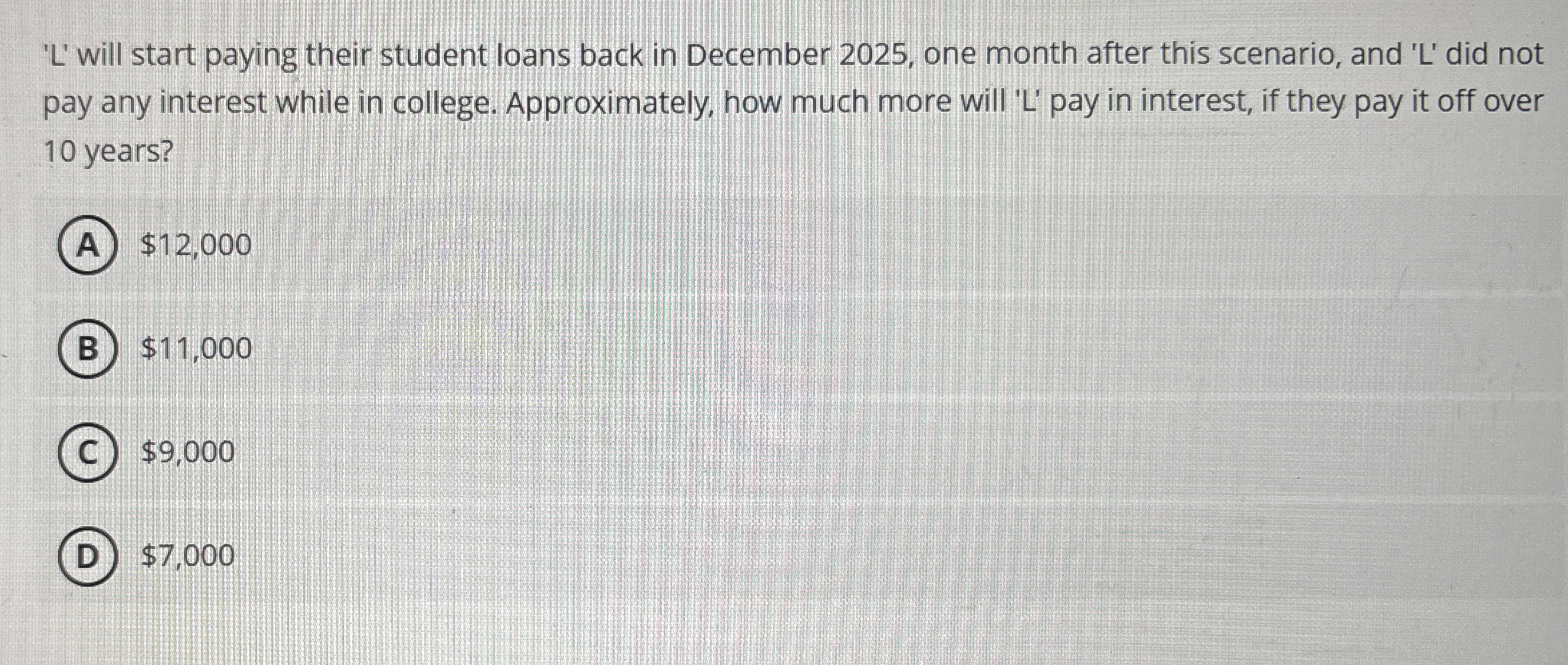

Question: ' L ' will start paying their student loans back in December 2 0 2 5 , one month after this scenario, and ' L

L will start paying their student loans back in December one month after this scenario, and L did not pay any interest while in college. Approximately, how much more will L pay in interest, if they pay it off over years?

$

$

$

$A firstyear fulltime employee, L earns $ at their fulltime job annually and works a hybrid schedule with a minute commute each way, miles each way round trip days a week L lives with their parents and a sibling in Waterbury, CT; sibling commutes to a private college. They contribute $ monthly for rent; they also contribute $ each month for utilities and renter's insurance. Ls parents buy general groceries, toiletries, and household items; L also buys food from the grocery store, as well as additional personal and daily living items if they want something specific.

L pays for their own auto insurance of $ a month to cover their yearold Honda Civic's insurance under family plan and has annual autoproperty tax of $ The car, which has miles, will require new brakes and tires by June as well as regular maintenance throughout the year; L has received an anticipated cost for all the repairs and regular maintenance, of about $

Each month L also contributes $pretax to their $ to general savings, and $ for their own cell phone plan. Llikes to go to NYC times a year to visit friends and do something at a venue, which on average, costs $ for the weekend.

Ls employer has a health care policy in place where the alum pays $ monthly for health insurance, as well as $ for copays, and $ for medication for a chronic condition; they need prescriptions filled each month and have four medical appts each year that require the copay. Note: last year, they visited urgent care twiceused their copayand needed three additional medications.

For debt, they currently have a threemonthold credit card balance of $ which includes interest, at an APR, after using their credit card for a onceinalifetime experience in July, that initially cost $ They want to pay off the credit card balance in a year or less if possible. Additionally, they face a $ student loan debt of with payments starting in December and want to pay it off as soon as possible, while also saving to move out and investing some money.

There is not any opportunity to earn overtime at Ls job, so when L wants some extra cash, if needed, they are an Uber driver in the Waterbury area for up to hours total time any given month

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock