Question: l X Youransweris incorrect. What will the bonds' amortized cost be at the maturity date? Bonds' amortized cost at the maturity date 55 E View

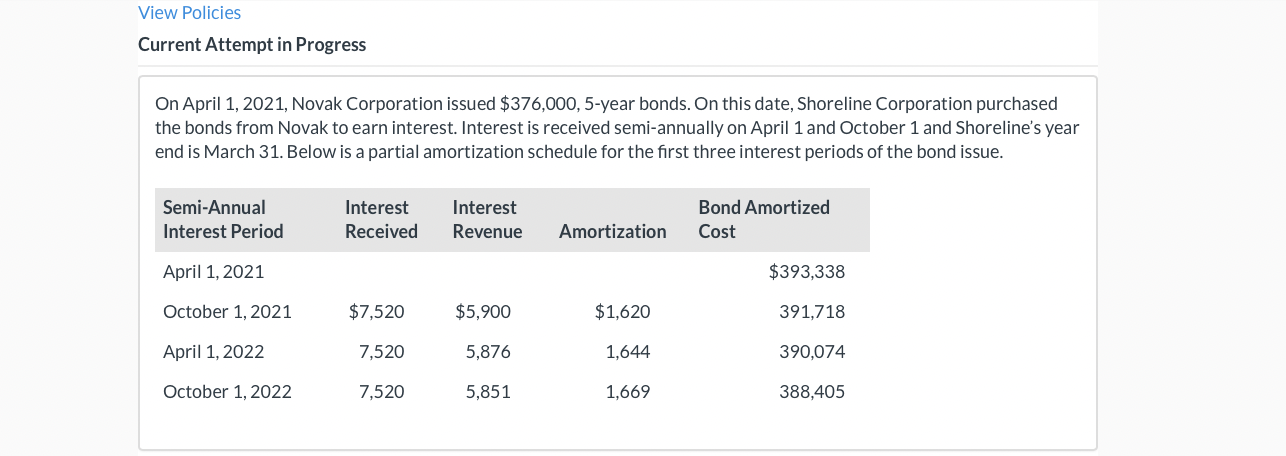

l X Youransweris incorrect. What will the bonds' amortized cost be at the maturity date? Bonds' amortized cost at the maturity date 55 E View Policies Current Attempt in Progress On April 1, 2021, Novak Corporation issued $376,000, 5-year bonds. On this date, Shoreline Corporation purchased the bonds from Novak to earn interest. Interest is received semi-annually on April 1 and October 1 and Shoreline's year end is March 31. Below is a partial amortization schedule for the first three interest periods of the bond issue. Semi-Annual Interest Interest Bond Amortized Interest Period Received Revenue Amortization Cost April 1, 2021 $393,338 October 1, 2021 $7,520 $5,900 $1,620 391,718 April 1, 2022 7,520 5,876 1,644 390,074 October 1, 2022 7,520 5,851 1,669 388,405

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts