Question: LA LLC purchased only one set during the current year a full 12-month tax yeur) On August 26 Las placed in service computer equipment five

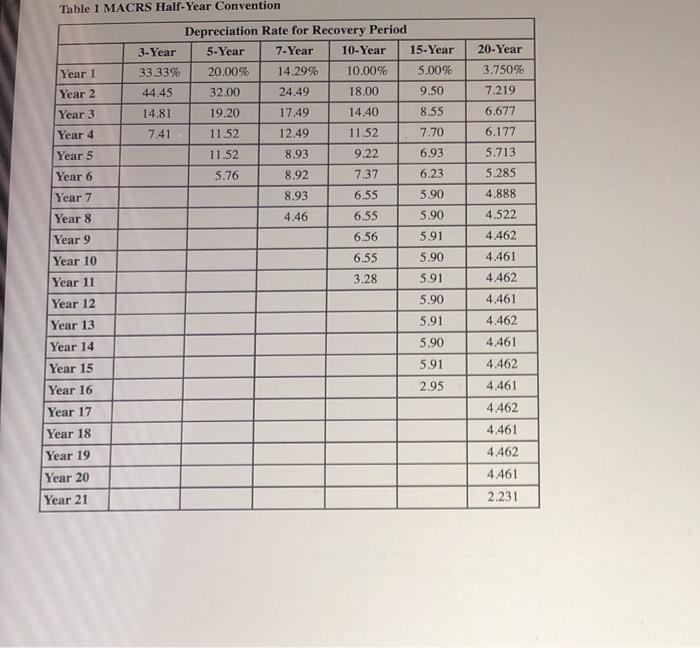

LA LLC purchased only one set during the current year a full 12-month tax yeur) On August 26 Las placed in service computer equipment five yen property with a basis of 534,000. Calculate the maximum depreciation expense for the current year gating 5179 and bonus depreciation (Use MACAS Table Choice $4.000 $5.800 O $6.800 None of the choices correct Table 1 MACRS Half-Year Convention 20-Year 3.750% Year 1 Year 2 7.219 Year 3 6.677 Year 4 Year 5 6.177 5.713 5.285 Year 6 Year 7 4.888 Depreciation Rate for Recovery Period 3-Year 5-Year 7-Year 10-Year 15-Year 33.33% 20.00% 14.29% 10.00% 5.00% 44.45 32.00 24.49 18.00 9.50 14.81 19.20 17.49 14.40 8.55 7.41 11.52 12.49 11.52 7.70 11.52 8.93 9.22 6.93 5.76 8.92 7.37 6.23 8.93 6.55 5.90 4.46 6.55 5.90 6.56 5.91 6.55 5.90 3.28 5.91 5.90 5.91 5.90 5.91 2.95 Year 8 4.522 Year 9 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 Year 16 Year 17 Year 18 Year 19 Year 20 Year 21 Lorchased only one to the current year 2-month tax your on August 26 Lax pieced in service comaute egument the year property with a basis of $34000 Calculate the memum recation dense for the current year inom 5179 and bona deprecato MACRS Table SCOO O 55 800 6.100 None of the choices are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts