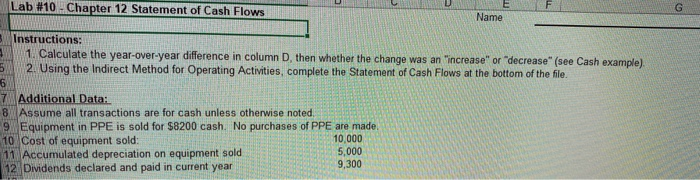

Question: Lab #10 - Chapter 12 Statement of Cash Flows E Name G - 3 Instructions: 1. Calculate the year-over-year difference in column D. then whether

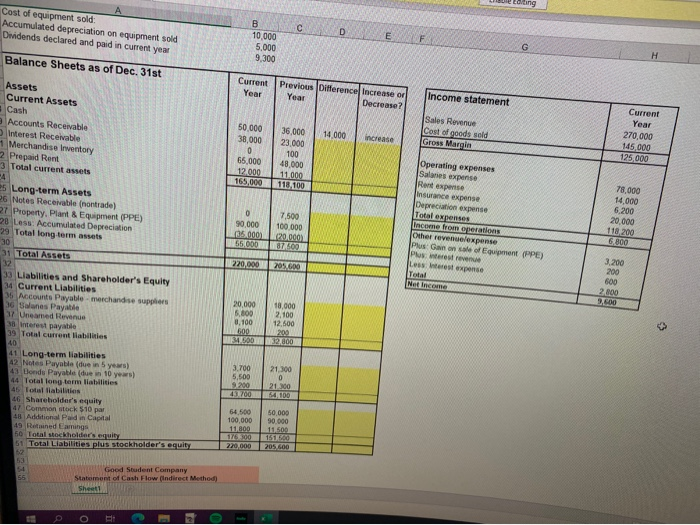

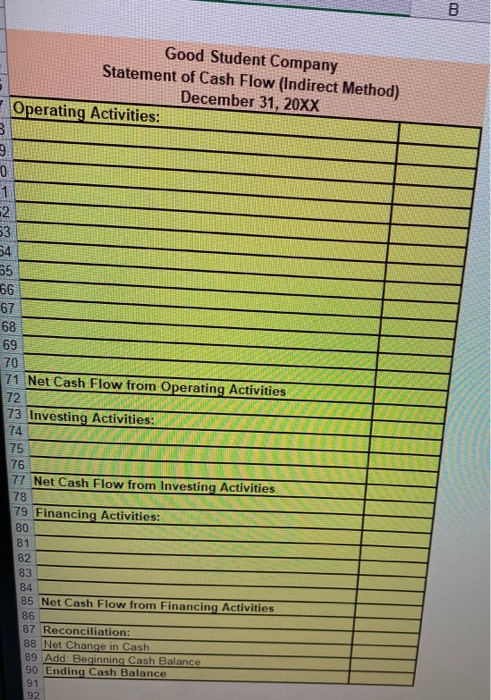

Lab #10 - Chapter 12 Statement of Cash Flows E Name G - 3 Instructions: 1. Calculate the year-over-year difference in column D. then whether the change was an "increase" or "decrease" (see Cash example) 2. Using the Indirect Method for Operating Activities, complete the Statement of Cash Flows at the bottom of the file. 6 7Additional Data: 8 Assume all transactions are for cash unless otherwise noted. 9 Equipment in PPE is sold for $8200 cash. No purchases of PPE are made 10 Cost of equipment sold: 10,000 Accumulated depreciation on equipment sold 5,000 9,300 12 Dividends declared and paid in current year Cost of equipment sold Accumulated depreciation on equipment sold Dividends declared and paid in Current year D E B 10,000 5,000 9,300 F G Balance Sheets as of Dec. 31st H Current Previous Difference Increase or Year Year Decrease? Income statement Assets Current Assets Cash Accounts Receivable Interest Receivable Merchandise Inventory 2 Prepaid Rent 3 Total current assets 50.000 38,000 14.000 Sales Revenue Cost of goods sold Gross Margin Increase Current Year 270.000 145,000 125.000 36.000 23.000 100 48,000 11.000 110.100 65,000 12.000 165,000 es Long-term Assets 26 Notes Receivable (nontrade) 27 Property. Plant & Equipment (PPE) 20 Less: Accumulated Depreciation 29 Total long term assets 30 31 Total Assets 0 90,000 35.000 55.000 7.500 100 000 120.000) Operating expenses Salones expenso Rent expertise Insurance expense Depreciation expense Tots expenses Income from operations Other revenuelexpense Plus Gaon sale of Equipment (PPE) Plutstreven Less Interest expense 78,000 14,000 6.200 20,000 118.200 6000 220,000 205.600 Total 3.200 200 600 2.800 Net Income 9,600 20,000 6.800 0.100 600 1.800 10.000 2,100 12.500 200 2,800 39 Liabilities and Shareholder's Equity 34 Current Liabilities 35 Accounts Payable - merchandise suppliers 36 Salones Payable 37 Uneared Revenue 30 interest payable 39 Total current liabilities 40 41 Long-term liabilities 42 Notes Puyable (due in 5 years) 43 Donds Payable (de 10 years) 44 Total long term liabilities 45 Total liabilis 46 Shareholder's equity 47 Common stock $10 par 48 Additional Pardin Capital 49 Retained Eaming 50 Total stockholders.eu 51 Total Liabilities plus stockholder's equity 3.700 5,500 9. 200 21 300 0 21.00 SIDO 64,500 100,000 50,000 90.000 220.000 151600 205.00 2 55 Good Student Company Statement of Cash Flow Indirect Method) Sheet1 B Good Student Company Statement of Cash Flow (Indirect Method) December 31, 20XX Operating Activities: m 9 0 1 2 63 54 55 66 67 68 69 70 71 Net Cash Flow from Operating Activities 72 73 Investing Activities: 74 75 76 77 Net Cash Flow from Investing Activities 78 79 Financing Activities: 80 81 82 83 84 85 Net Cash Flow from Financing Activities 86 87 Reconciliation: 88 Net Change in Cash 89 Add: Beginning Cash Balance 90 Ending Cash Balance 91 92

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts