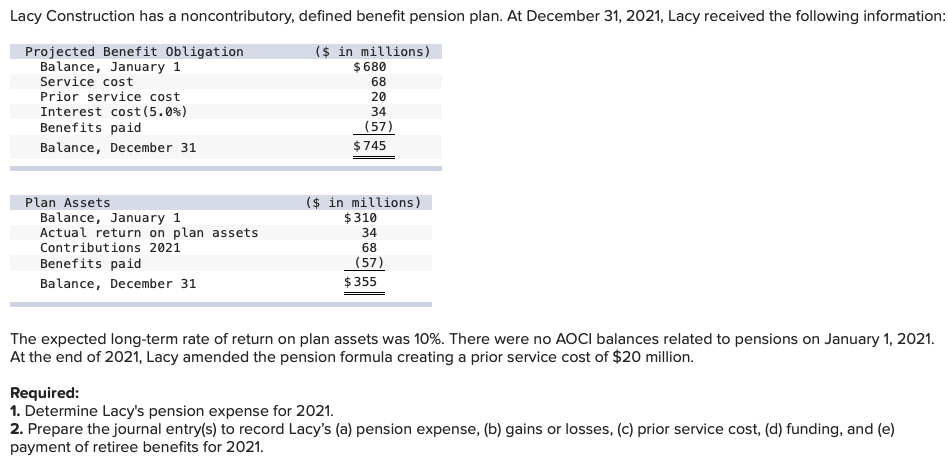

Question: Lacy Construction has a noncontributory, defined benefit pension plan. At December 31, 2021, Lacy received the following information: Projected Benefit Obligation Balance, January 1 Service

Lacy Construction has a noncontributory, defined benefit pension plan. At December 31, 2021, Lacy received the following information: Projected Benefit Obligation Balance, January 1 Service cost Prior service cost Interest cost(5.0%) Benefits paid Balance, December 31 ($ in millions) $ 680 68 20 34 (57) $ 745 Plan Assets Balance, January 1 Actual return on plan assets Contributions 2021 Benefits paid Balance, December 31 ($ in millions) $310 34 68 (57) $355 The expected long-term rate of return on plan assets was 10%. There were no AOCI balances related to pensions on January 1, 2021. At the end of 2021, Lacy amended the pension formula creating a prior service cost of $20 million. Required: 1. Determine Lacy's pension expense for 2021. 2. Prepare the journal entry(s) to record Lacy's (a) pension expense, (b) gains or losses, (c) prior service cost, (d) funding, and (e) payment of retiree benefits for 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts