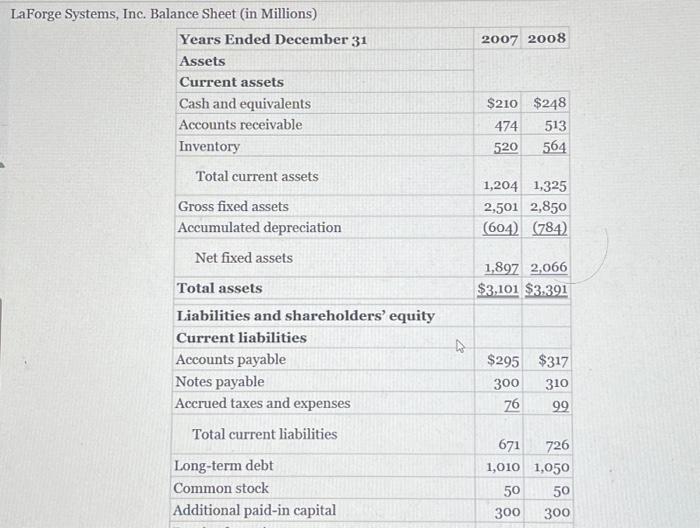

Question: LaForge Systems, Inc. Balance Sheet (in Millions) Note: The statement of cash flows shows the use of a convention by which the positive numbers of

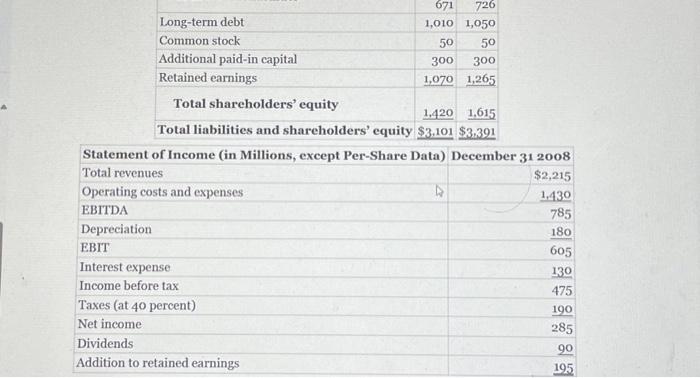

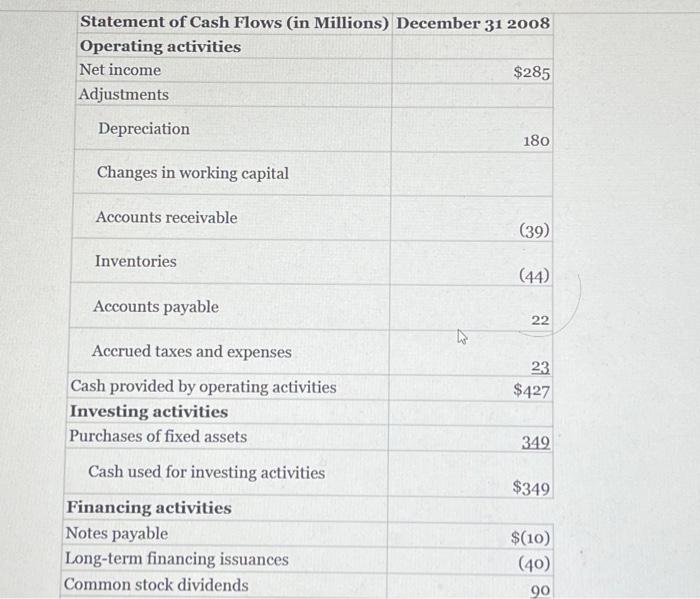

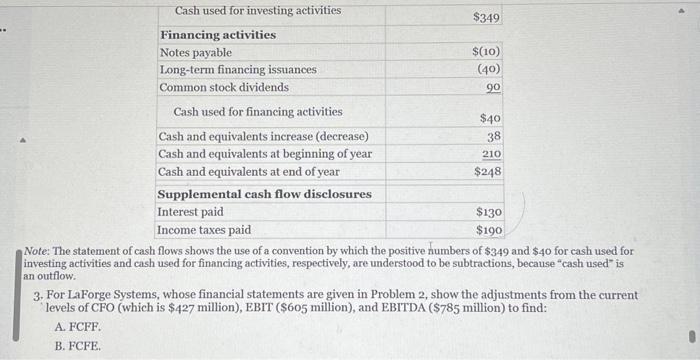

LaForge Systems, Inc. Balance Sheet (in Millions) Note: The statement of cash flows shows the use of a convention by which the positive numbers of $349 and $40 for cash used for investing activities and cash used for financing activities, respectively, are understood to be subtractions, because "cash used" is an outflow. 3. For LaForge Systems, whose financial statements are given in Problem 2, show the adjustments from the current levels of CFO (which is \$427 million), EBTT (\$605 million), and EBITDA (\$785 million) to find: A. FCFF. B. FCFE. \begin{tabular}{|c|c|} \hline Statement of Cash Flows (in Millions) & December 312008 \\ \hline \multicolumn{2}{|l|}{ Operating activities } \\ \hline Net income & $285 \\ \hline \multicolumn{2}{|l|}{ Adjustments } \\ \hline Depreciation & 180 \\ \hline \multicolumn{2}{|l|}{ Changes in working capital } \\ \hline Accounts receivable & (39) \\ \hline \multicolumn{2}{|l|}{ Inventories } \\ \hline \multicolumn{2}{|l|}{ Accounts payable } \\ \hline Accrued taxes and expenses & 18 \\ \hline Cash provided by operating activities & $427 \\ \hline \multicolumn{2}{|l|}{ Investing activities } \\ \hline Purchases of fixed assets & 349 \\ \hline Cash used for investing activities & $349 \\ \hline \multicolumn{2}{|l|}{ Financing activities } \\ \hline Notes payable & $(10) \\ \hline Long-term financing issuances & (40) \\ \hline Common stock dividends & 90 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline Long-term debt & 1,010 & 1,050 \\ \hline Common stock & 50 & 50 \\ \hline Additional paid-in capital & 300 & 300 \\ \hline Retained earnings & 1,070 & 1,265 \\ \hline \multicolumn{1}{|c|}{ Total shareholders' equity } & & \\ \hline Total liabilities and shareholders' equity & $3,101 & 1,615 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline Statement of Income (in Millions, except Per-Share Data) & December 312008 \\ \hline Total revenues & $2,215 \\ \hline Operating costs and expenses & 1,430 \\ \hline EBITDA & 785 \\ \hline Depreciation & 180 \\ \hline EBrT & 605 \\ \hline Interest expense & 130 \\ \hline Income before tax & 475 \\ \hline Taxes (at 40 percent) & 190 \\ \hline Net income & 285 \\ \hline Dividends & 90 \\ \hline Addition to retained earnings & 195 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts