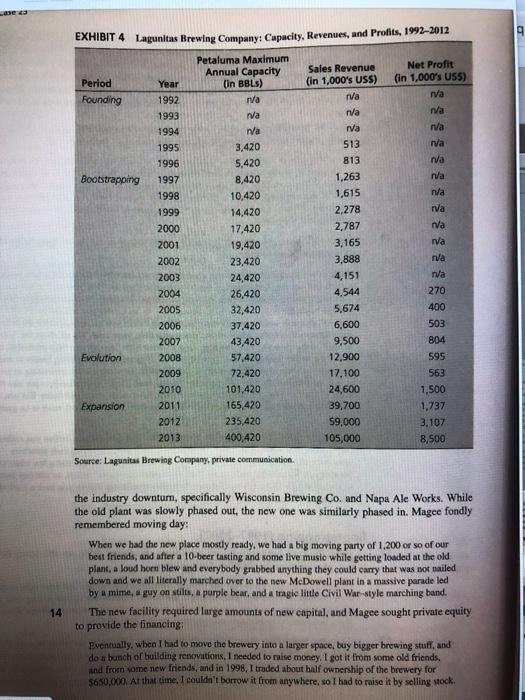

Question: LAGUNITAS BREWING COMPANY,INC., 2013 CASE QUESTIONS 1. Using the data in Exh. 4, calculate the sales revenue per barrel of capacity, and ROS (profit divided

LAGUNITAS BREWING COMPANY,INC., 2013 CASE QUESTIONS 1. Using the data in Exh. 4, calculate the sales revenue per barrel of capacity, and ROS (profit divided by sales revenue) for the years 2004-13. What do you conclude from these? 2. So many craft brewers went out of business starting in 1997, but Lagunitas steadily expanded. How do you account for this success? 3. Which generic strategy is Tony Magee pursuing? Which grand strategy/ies? 4. What are the one biggest opportunity and one biggest threat facing Lagunitas, and the causes of each? 5. What are Tony Magees options for dealing with the opportunity and threat? 6. What should Tony Magee do? Why will it succeed?

g ra EXHIBIT 4 Lagunitas Brewing Company: Capacity, Revenues, and Profits, 1992-2012 Petaluma Maximum Annual Capacity Sales Revenue Net Profit Period Year (in BBL) (in 1,000's USS) (in 1,000's U55) Founding 1992 ra Iva 1993 wa n/a ra 1994 wa rva ra 1995 3,420 513 rva 1996 5,420 813 wa Bootstrapping 1997 8,420 1,263 ra 1998 10,420 1,615 va 1999 14,420 2,278 rva 2000 17,420 2,787 ra 2001 19,420 3,165 wa 23,420 3,888 na 2003 24,420 4,151 na 2004 26,420 4,544 270 2005 32,420 5,674 2006 37,420 6,600 503 2007 43,420 9,500 804 Evolution 2008 57,420 12.900 595 2009 72,420 17.100 563 2010 101,420 24,600 1,500 Expansion 2011 165,420 39,700 1,737 2012 235,420 59,000 3.107 2013 400,420 105,000 8,500 Source: Lagunitas Brewing Company, private communication 2002 400 the industry downturn, specifically Wisconsin Brewing Co. and Napa Ale Works. While the old plant was slowly phased out, the new one was similarly phased in. Magee fondly remembered moving day: When we had the new place mostly ready, we had a big moving party of 1.200 or so of our best friends, and after a 10-beer tasting and some live music while getting loaded at the old plant, a loud horn blew and everybody grabbed anything they could carry that was not nailed down and we all literally marched over to the new McDowell plant in a massive parade led by a mime, a guy on stilts, a purple bear, and a tragie little Civil War-style marching band. The new facility required lurge amounts of new capital and Magee sought private equity to provide the financing Eventually, when I had to wave the brewery into a larger space, buy bigger brewing stuff, and do n bunch of building renovations. I needed to maise money, I got it from some old friends, and from some new friends, and in 1998, I traded about half ownership of the brewery for 5650,000. At that time. I couldn't borrow it from anywhere, so I had to raise it by selling stock 14 g ra EXHIBIT 4 Lagunitas Brewing Company: Capacity, Revenues, and Profits, 1992-2012 Petaluma Maximum Annual Capacity Sales Revenue Net Profit Period Year (in BBL) (in 1,000's USS) (in 1,000's U55) Founding 1992 ra Iva 1993 wa n/a ra 1994 wa rva ra 1995 3,420 513 rva 1996 5,420 813 wa Bootstrapping 1997 8,420 1,263 ra 1998 10,420 1,615 va 1999 14,420 2,278 rva 2000 17,420 2,787 ra 2001 19,420 3,165 wa 23,420 3,888 na 2003 24,420 4,151 na 2004 26,420 4,544 270 2005 32,420 5,674 2006 37,420 6,600 503 2007 43,420 9,500 804 Evolution 2008 57,420 12.900 595 2009 72,420 17.100 563 2010 101,420 24,600 1,500 Expansion 2011 165,420 39,700 1,737 2012 235,420 59,000 3.107 2013 400,420 105,000 8,500 Source: Lagunitas Brewing Company, private communication 2002 400 the industry downturn, specifically Wisconsin Brewing Co. and Napa Ale Works. While the old plant was slowly phased out, the new one was similarly phased in. Magee fondly remembered moving day: When we had the new place mostly ready, we had a big moving party of 1.200 or so of our best friends, and after a 10-beer tasting and some live music while getting loaded at the old plant, a loud horn blew and everybody grabbed anything they could carry that was not nailed down and we all literally marched over to the new McDowell plant in a massive parade led by a mime, a guy on stilts, a purple bear, and a tragie little Civil War-style marching band. The new facility required lurge amounts of new capital and Magee sought private equity to provide the financing Eventually, when I had to wave the brewery into a larger space, buy bigger brewing stuff, and do n bunch of building renovations. I needed to maise money, I got it from some old friends, and from some new friends, and in 1998, I traded about half ownership of the brewery for 5650,000. At that time. I couldn't borrow it from anywhere, so I had to raise it by selling stock 14