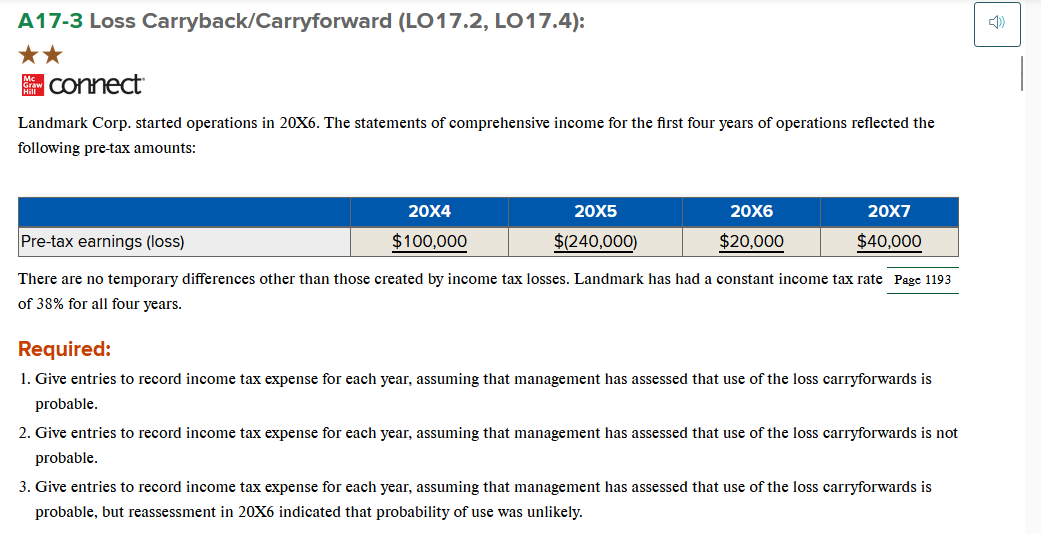

Question: Landmark Corp. started operations in 2 0 X 6 . The statements of comprehensive income for the first four years of operations reflected the following

Landmark Corp. started operations in X The statements of comprehensive income for the first four years of operations reflected the following pretax amounts:

There are no temporary differences other than those created by income tax losses. Landmark has had a constant income tax rate

of for all four years.

Required:

Give entries to record income tax expense for each year, assuming that management has assessed that use of the loss carryforwards is probable.

Give entries to record income tax expense for each year, assuming that management has assessed that use of the loss carryforwards is not probable.

Give entries to record income tax expense for each year, assuming that management has assessed that use of the loss carryforwards is probable, but reassessment in X indicated that probability of use was unlikely.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock