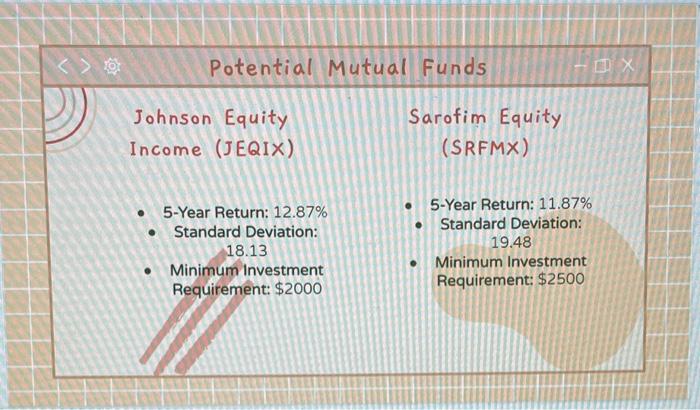

Question: langle angle Potential Mutual Funds )) Johnson Equity Sarofim Equity Income (JEQIX) (SRFMX) - 5-Year Return: 12.87% - 5-Year Return: 11.87% - Standard Deviation: -

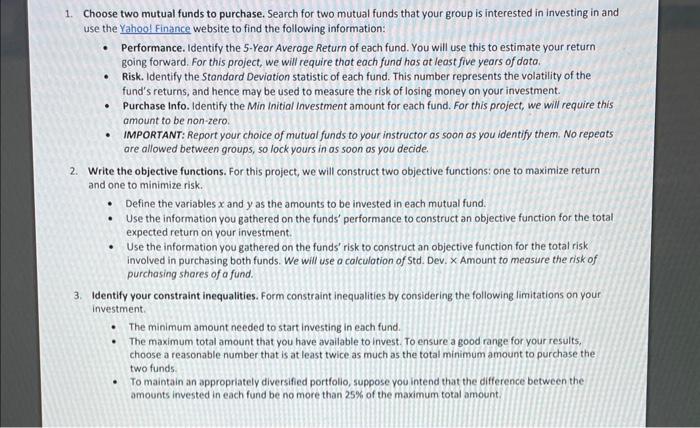

\langle angle Potential Mutual Funds )) Johnson Equity Sarofim Equity Income (JEQIX) (SRFMX) - 5-Year Return: 12.87% - 5-Year Return: 11.87% - Standard Deviation: - Standard Deviation: 18.13 n. . 19.48 - Minimum investment - Minimum Investment Requirement: $2000 1. Choose two mutual funds to purchase. Search for two mutual funds that your group is interested in investing in and use the Yahool Finance website to find the following information: - Performance. Identify the 5-Year Average Return of each fund. You will use this to estimate your return going forward. For this project, we will require that each fund has at least five years of data. - Risk. Identify the Standard Deviation statistic of each fund. This number represents the volatility of the fund's returns, and hence may be used to measure the risk of losing money on your investment. - Purchase info. Identify the Min Initial investment amount for each fund. For this project, we will require this amount to be non-zero. - IMPORTANT: Report your choice of mutual funds to your instructor as soon as you identify them. No repeats are allowed between groups, so lock yours in as soon as you decide. 2. Write the objective functions. For this project, we will construct two objective functions: one to maximize return and one to minimize risk. - Define the variables x and y as the amounts to be invested in each mutual fund. - Use the information you gathered on the funds' performance to construct an objective function for the total expected return on your investment. - Use the information you gathered on the funds' risk to construct an objective function for the total risk involved in purchasing both funds. We will use a calculation of Std. Dev. Amount to measure the risk of purchasing shares of a fund. 3. Identify your constraint inequalities. Form constraint inequalities by considering the following limitations on your investment. - The minimum amount needed to start investing in each fund. - The maximum total amount that you have available to invest. To ensure a good range for your results, choose a reasonable number that is at least twice as much as the total minimum amount to purchase the two funds. - To maintain an appropriately diversified portfolio, suppose you intend that the difference between the amounts invested in each fund be no more than 25% of the maximum total amount. \langle angle Potential Mutual Funds )) Johnson Equity Sarofim Equity Income (JEQIX) (SRFMX) - 5-Year Return: 12.87% - 5-Year Return: 11.87% - Standard Deviation: - Standard Deviation: 18.13 n. . 19.48 - Minimum investment - Minimum Investment Requirement: $2000 1. Choose two mutual funds to purchase. Search for two mutual funds that your group is interested in investing in and use the Yahool Finance website to find the following information: - Performance. Identify the 5-Year Average Return of each fund. You will use this to estimate your return going forward. For this project, we will require that each fund has at least five years of data. - Risk. Identify the Standard Deviation statistic of each fund. This number represents the volatility of the fund's returns, and hence may be used to measure the risk of losing money on your investment. - Purchase info. Identify the Min Initial investment amount for each fund. For this project, we will require this amount to be non-zero. - IMPORTANT: Report your choice of mutual funds to your instructor as soon as you identify them. No repeats are allowed between groups, so lock yours in as soon as you decide. 2. Write the objective functions. For this project, we will construct two objective functions: one to maximize return and one to minimize risk. - Define the variables x and y as the amounts to be invested in each mutual fund. - Use the information you gathered on the funds' performance to construct an objective function for the total expected return on your investment. - Use the information you gathered on the funds' risk to construct an objective function for the total risk involved in purchasing both funds. We will use a calculation of Std. Dev. Amount to measure the risk of purchasing shares of a fund. 3. Identify your constraint inequalities. Form constraint inequalities by considering the following limitations on your investment. - The minimum amount needed to start investing in each fund. - The maximum total amount that you have available to invest. To ensure a good range for your results, choose a reasonable number that is at least twice as much as the total minimum amount to purchase the two funds. - To maintain an appropriately diversified portfolio, suppose you intend that the difference between the amounts invested in each fund be no more than 25% of the maximum total amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts