Question: Langtry Falls Expansion Plan What hurdle rate do you suggest should be sued to evaluate the expansion plan? Your analysis should include a calculation of

Langtry Falls Expansion Plan

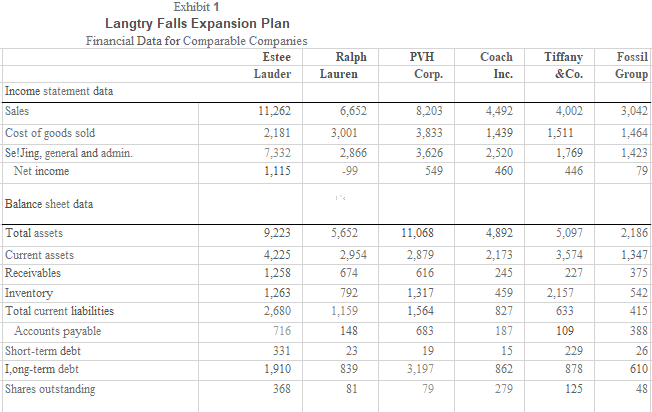

What hurdle rate do you suggest should be sued to evaluate the expansion plan? Your analysis should include a calculation of the WACC for each of the competitors as well as a justification for the selection of which competitors (possibly all) are relevant to your recommendation.

Ralph Lauren PVH Corp. Coach Inc. Tiffany &Co. Fossil Group Exhibit 1 Langtry Falls Expansion Plan Financial Data for Comparable Companies Estee Lauder Income statement data Sales 11,262 Cost of goods sold 2,181 Se!Jing, general and admin. 7,332 Net income 1,115 6,652 3,001 2.866 -99 8,203 3,833 3,626 549 4,492 1,439 2,520 460 4,002 1,511 1,769 446 3,042 1,464 1,423 79 Balance sheet data Total assets 4,892 2.173 245 2,186 1,347 375 Current assets Receivables Inventory Total current liabilities Accounts payable Short-term debt I, ong-term debt Shares outstanding 9,223 4,225 1,258 1,263 2,680 716 331 1,910 368 5,652 2,954 674 792 1,159 148 11,068 2,879 616 1,317 1,564 683 19 3,197 79 459 827 187 15 862 5,097 3,574 227 2.157 633 109 229 878 542 415 388 26 610 23 839 81 279 125 48

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts