Question: Lars acquired a new network system on June 5 , 2 0 2 3 ( five - year class property ) , for $ 7

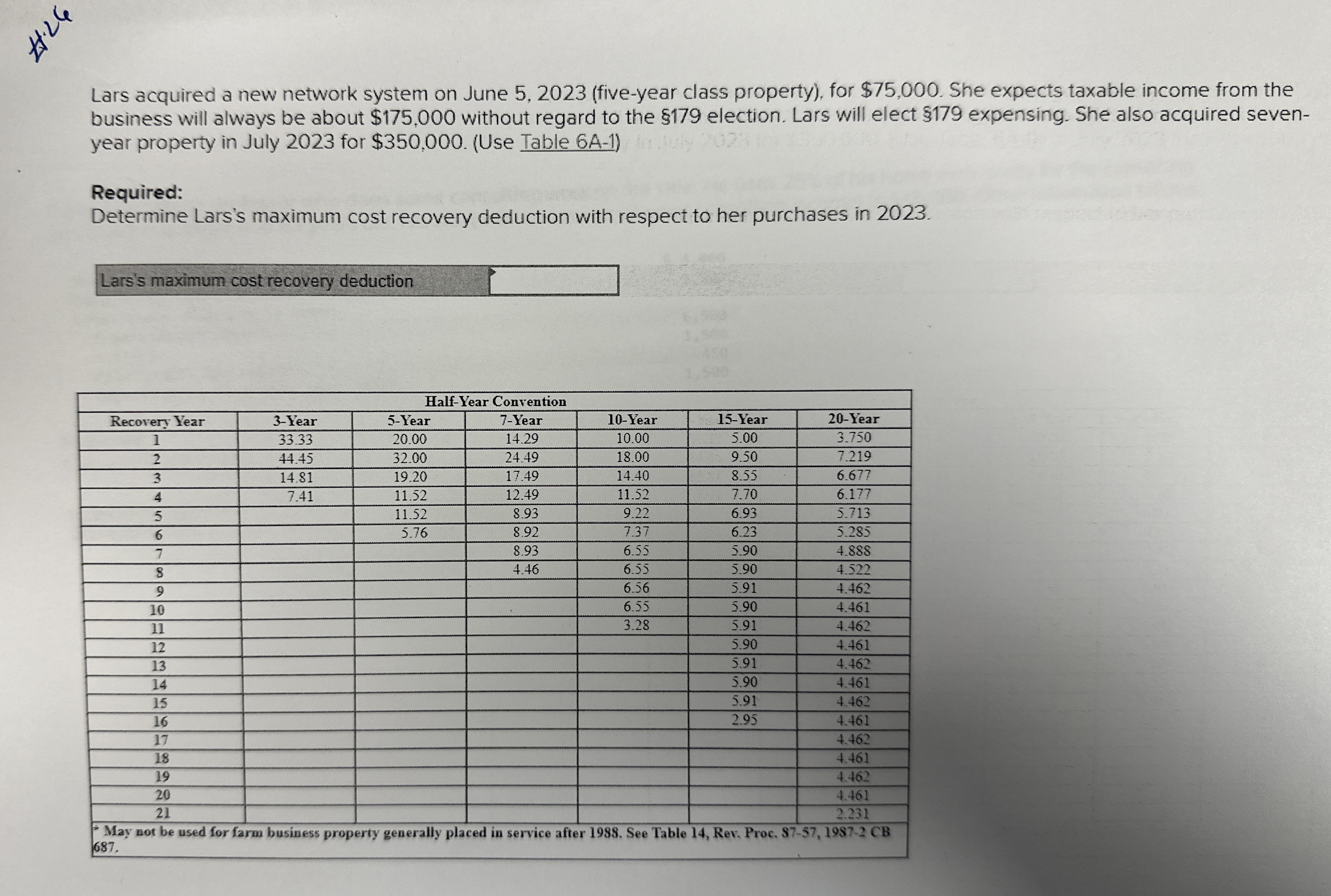

Lars acquired a new network system on June fiveyear class property for $ She expects taxable income from the business will always be about $ without regard to the $ election. Lars will elect $ expensing. She also acquired sevenyear property in July for $Use Table A

Required:

Determine Lars's maximum cost recovery deduction with respect to her purchases in

Lars's maximum cost recovery deduction

May not be used for farm business property generally placed in service after See Table Rev. Proc. CB

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock