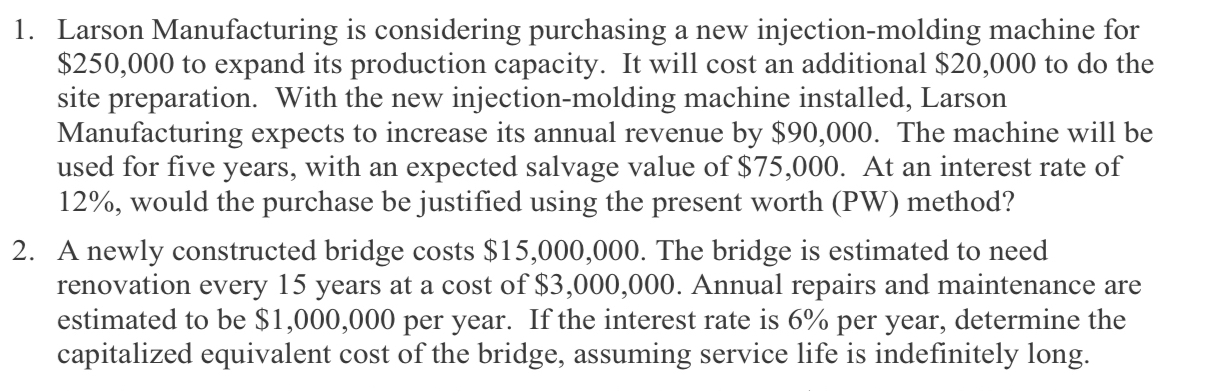

Question: Larson Manufacturing is considering purchasing a new injection - molding machine for $ 2 5 0 , 0 0 0 to expand its production capacity.

Larson Manufacturing is considering purchasing a new injectionmolding machine for $ to expand its production capacity. It will cost an additional $ to do the site preparation. With the new injectionmolding machine installed, Larson Manufacturing expects to increase its annual revenue by $ The machine will be used for five years, with an expected salvage value of $ At an interest rate of would the purchase be justified using the present worth PW method?

A newly constructed bridge costs $ The bridge is estimated to need renovation every years at a cost of $ Annual repairs and maintenance are estimated to be $ per year. If the interest rate is per year, determine the capitalized equivalent cost of the bridge, assuming service life is indefinitely long.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock