Question: Las c om- -Delete Connect US Device Send Chri Ray Malled Share B . QI: If Lemma has sales of AED 800 million, net income

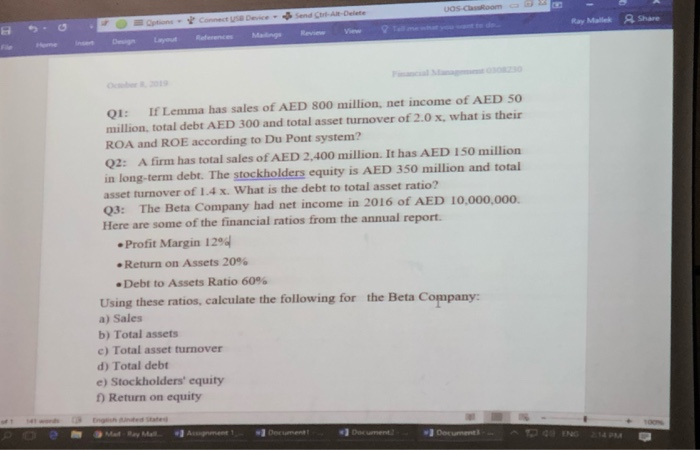

Las c om- -Delete Connect US Device Send Chri Ray Malled Share B . QI: If Lemma has sales of AED 800 million, net income of AED 50 million total debt AED 300 and total asset turnover of 2.0 x, what is their ROA and ROE according to Du Pont system? Q2: A firm has total sales of AED 2,400 million. It has AED 150 million in long-term debt. The stockholders equity is AED 350 million and total asset turnover of 1.4 x. What is the debt to total asset ratio? Q3: The Beta Company had net income in 2016 of AED 10.000.000 Here are some of the financial ratios from the annual report Profit Margin 1290 . Return on Assets 2096 Debt to Assets Ratio 60% Using these ratios, calculate the following for the Beta Company: a) Sales b) Total assets c) Total asset turnover d) Total debt e) Stockholders' equity 1) Return on equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts