Question: Lasik Vision Inc. recently analyzed the project whose cash flows are shown below. However, before Lasik decided to accept or reject the project, the Federal

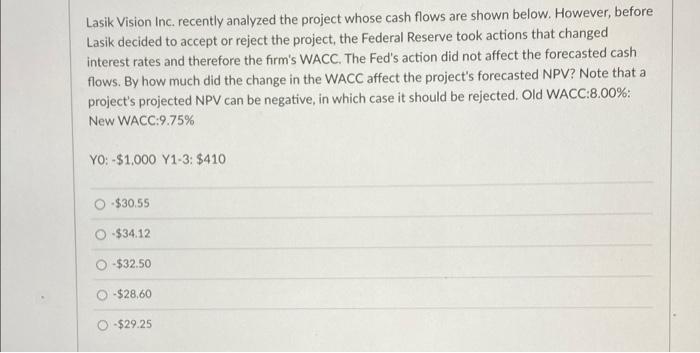

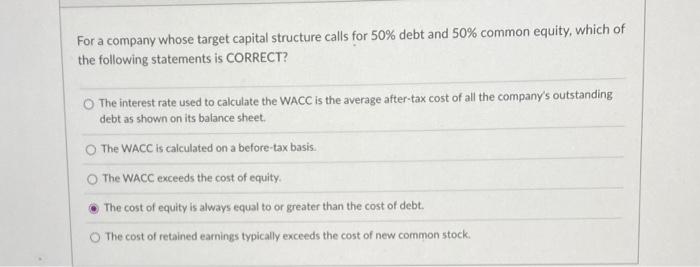

Lasik Vision Inc. recently analyzed the project whose cash flows are shown below. However, before Lasik decided to accept or reject the project, the Federal Reserve took actions that changed interest rates and therefore the firm's WACC. The Fed's action did not affect the forecasted cash flows. By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's projected NPV can be negative, in which case it should be rejected. Old WACC:8.00%: New WACC:9.75% YO:-$1.000 Y1-3: $410 $30.55 -$34.12 $32.50 -$28,60 -$29.25 For a company whose target capital structure calls for 50% debt and 50% common equity, which of the following statements is CORRECT? The interest rate used to calculate the WACC is the average after-tax cost of all the company's outstanding debt as shown on its balance sheet. The WACC is calculated on a before-tax basis. The WACC exceeds the cost of equity The cost of equity is always equal to or greater than the cost of debt. The cost of retained earnings typically exceeds the cost of new common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts