Question: Lasik Vision Inc. recently analyzed the project whose cash flows are shown below. However, before Lasik decided to accept or reject the project, the Federal

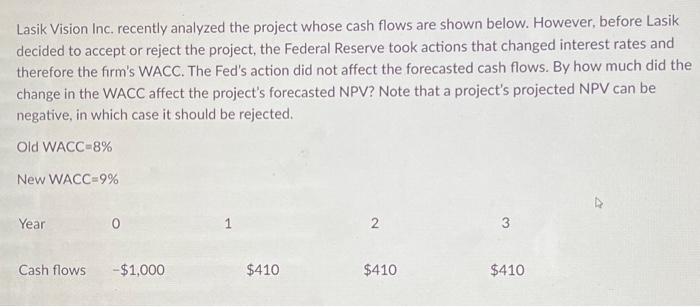

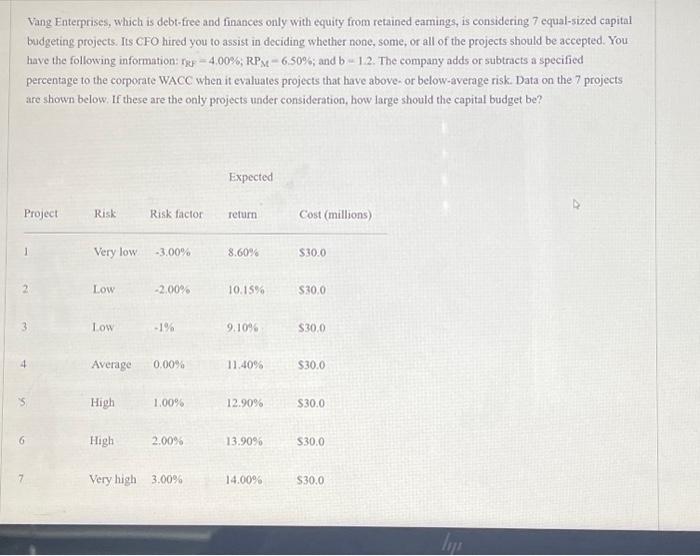

Lasik Vision Inc. recently analyzed the project whose cash flows are shown below. However, before Lasik decided to accept or reject the project, the Federal Reserve took actions that changed interest rates and therefore the firm's WACC. The Fed's action did not affect the forecasted cash flows. By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's projected NPV can be negative, in which case it should be rejected. Old WACC =8% New WACC =9% Year 0 1 2 3 Cash flows $1,000 $410 $410 $410 Vang Enterprises, which is debt-free and finances only with equity from retained eamings, is considering 7 equal-sized capital budgeting projects. Its CFO hired you to assist in deciding whether none, some, or all of the projects should be accepted. You have the following information: rRF=4.00%;RPM6.50%; and b=1.2. The company adds or subtracts a specified percentage to the corporate WACC when it evaluates projects that have above-or below-average risk. Data on the 7 projects are shown below, If these are the only projects under consideration, how large should the capital budget be? Expected 7Veryhigh3.00%14.00%$30.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts