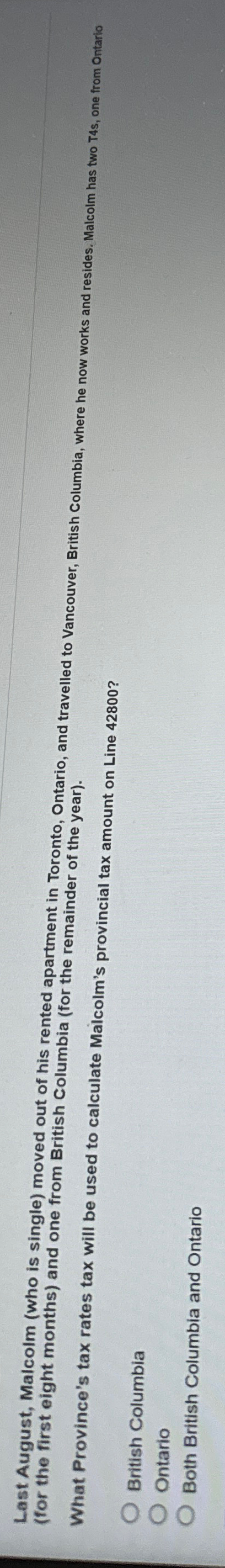

Question: Last August, Malcolm ( who is single ) moved out of his rented apartment in Toronto, Ontario, and travelled to Vancouver, British Columbia, where he

Last August, Malcolm who is single moved out of his rented apartment in Toronto, Ontario, and travelled to Vancouver, British Columbia, where he now works and resides. Malcolm has two Ts one from Ontario for the first eight months and one from British Columbia for the remainder of the year

What Province's tax rates tax will be used to calculate Malcolm's provincial tax amount on Line

British Columbia

Ontario

Both British Columbia and Ontario

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock