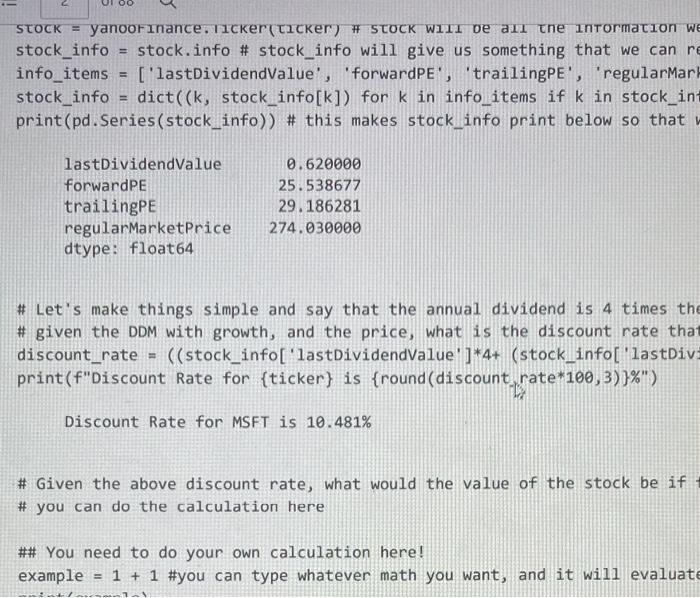

Question: last divident value is 0.62 274.03 current value i need the answer for 274.03 current value. i understand that right now it is 277.35 but

Q1.2 We'll take the annual dividend as 4 times the last dividend. Assume a growth rate of 9.49%. Given the DDM, what is the implied discount rate for MSFT given the current price? STOCK = yanooFinance. 11cker (ticker) # STOCK WIIT ve all the information we stock_info = stock.info # stock_info will give us something that we can re info_items ['lastDividendValue', 'forwardPE', 'trailingPE', 'regularmar stock_info dict((k, stock_info[k]) for k in info_items if k in stock_in print(pd. Series(stock_info)) # this makes stock_info print below so that lastDividendValue forwardPE trailingPE regularMarketPrice dtype: float64 0.620000 25.538677 29.186281 274.030000 # Let's make things simple and say that the annual dividend is 4 times the # given the DDM with growth, and the price, what is the discount rate that discount_rate = ((stock_info['lastDividendValue' ]*4+ (stock_info['lastDiv print(f"Discount Rate for {ticker) is {round (discount, rate*100,3)}%") Discount Rate for MSFT is 10.481% # Given the above discount rate, what would the value of the stock be if # you can do the calculation here ## You need to do your own calculation here! example = 1 + 1 #you can type whatever math you want, and it will evaluate =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts