Question: last time this was answered it was incorrect. pls help! Zachary Construction Company expects to build three new homes during a specific accounting period. The

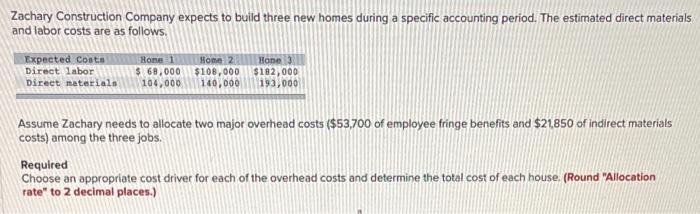

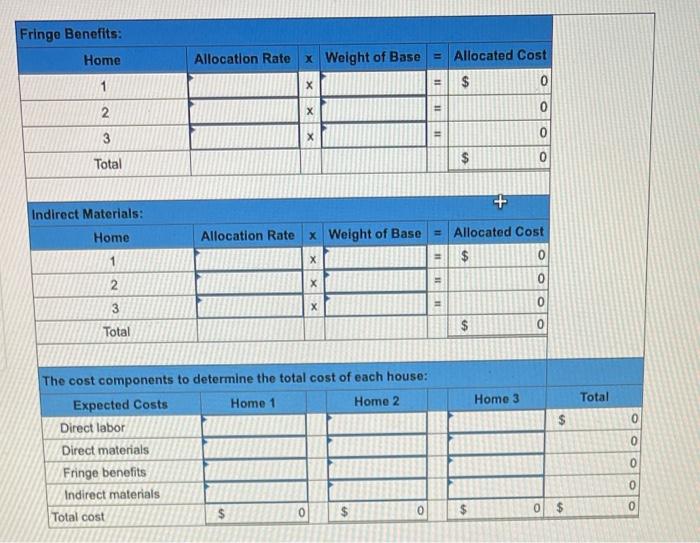

Zachary Construction Company expects to build three new homes during a specific accounting period. The estimated direct materials and labor costs are as follows, Expected Coats Direct labor Direct materials Home 1 Home 2 Hone 3 $ 68,000 $108,000 $102,000 104,000 140,000 193,000 Assume Zachary needs to allocate two major overhead costs ($53,700 of employee fringe benefits and $21.850 of indirect materials costs) among the three jobs. Required Choose an appropriate cost driver for each of the overhead costs and determine the total cost of each house. (Round "Allocation rate" to 2 decimal places.) Fringe Benefits: Home Allocation Rate x Weight of Base = Allocated Cost $ 1 x 2 11 11 0 0 o 0 3 0 0 Total $ + Indirect Materials: Home Allocation Rate x Weight of Base = Allocated Cost 11 $ 1 2 1111 o 0 0 0 3 Total $ $ Home 3 Total $ 0 The cost components to determine the total cost of each house: Expected Costs Home 1 Home 2 Direct labor Direct materials Fringe benefits Indirect materials Total cost $ 0 0 0 $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts