Question: (Last two pictures if an example problem to help) 1. Complete the amortization schedule below using the following information: Loan amount: $1,000,000; fully amortized Term:

(Last two pictures if an example problem to help)

(Last two pictures if an example problem to help)

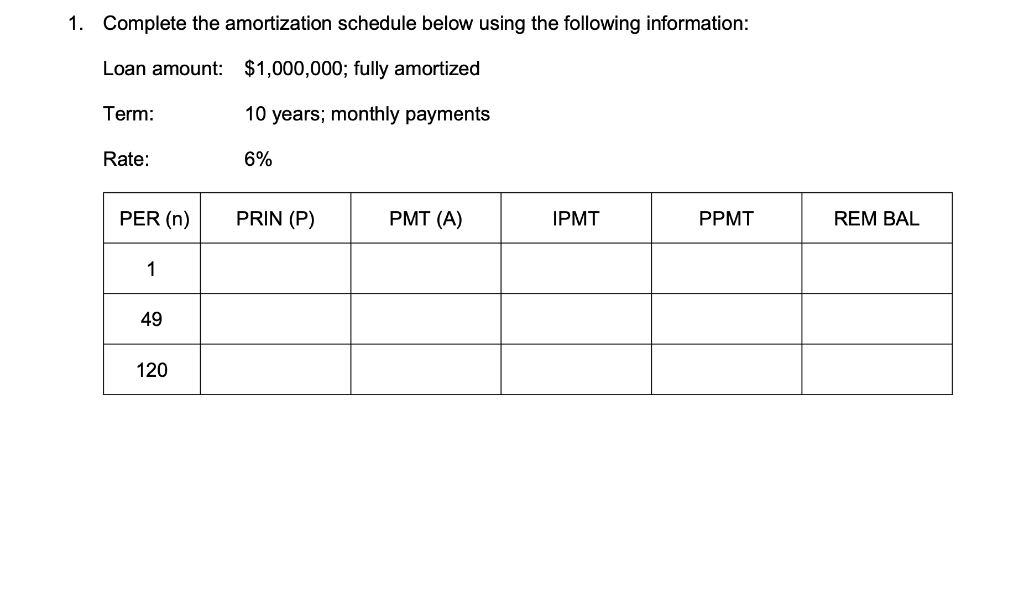

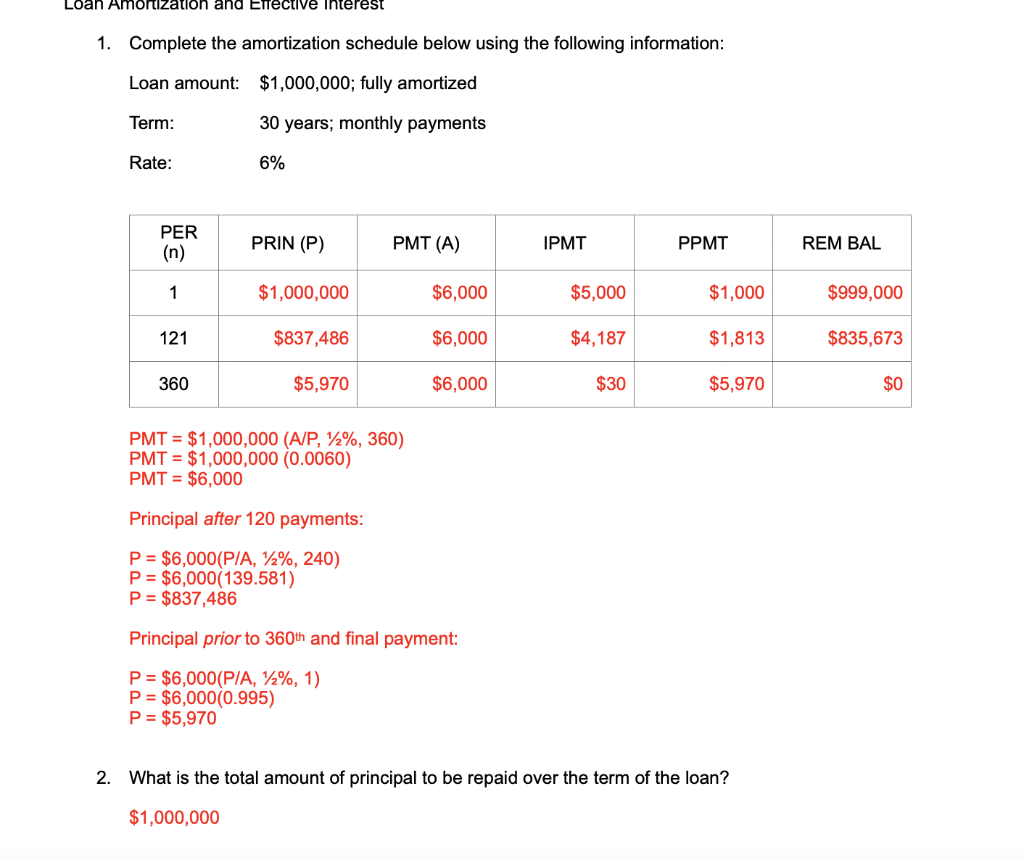

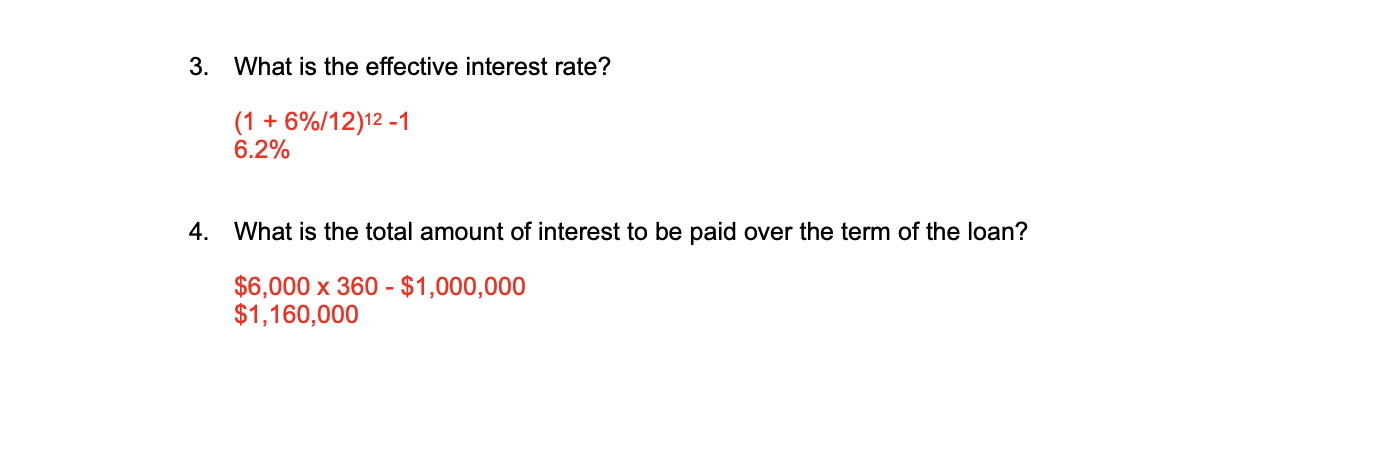

1. Complete the amortization schedule below using the following information: Loan amount: $1,000,000; fully amortized Term: 10 years; monthly payments Rate: 6% PER (n) PRIN (P) PMT (A) IPMT PPMT REM BAL 1 49 120 2. What is the total amount of principal to be repaid over the term of the loan? 3. What is the effective interest rate? 4. What is the total amount of interest to be paid over the term of the loan? Loan Amortization and Errective interest 1. Complete the amortization schedule below using the following information: Loan amount: $1,000,000; fully amortized Term: 30 years; monthly payments Rate: 6% PER (n) PRIN (P) PMT (A) IPMT PPMT REM BAL 1 $1,000,000 $6,000 $5,000 $1,000 $999,000 121 $837,486 $6,000 $4,187 $1,813 $835,673 360 $5,970 $6,000 $30 $5,970 $0 PMT = $1,000,000 (A/P, 12%, 360) PMT = $1,000,000 (0.0060) PMT = $6,000 Principal after 120 payments: P = $6,000(P/A, 12%, 240) P = $6,000(139.581) P = $837,486 Principal prior to 360th and final payment: P = $6,000(P/A, 12%, 1) P = $6,000(0.995) P = $5,970 2. What is the total amount of principal to be repaid over the term of the loan? $1,000,000 3. What is the effective interest rate? (1 + 6%/12)12 -1 6.2% 4. What is the total amount of interest to be paid over the term of the loan? $6,000 x 360 - $1,000,000 $1,160,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts