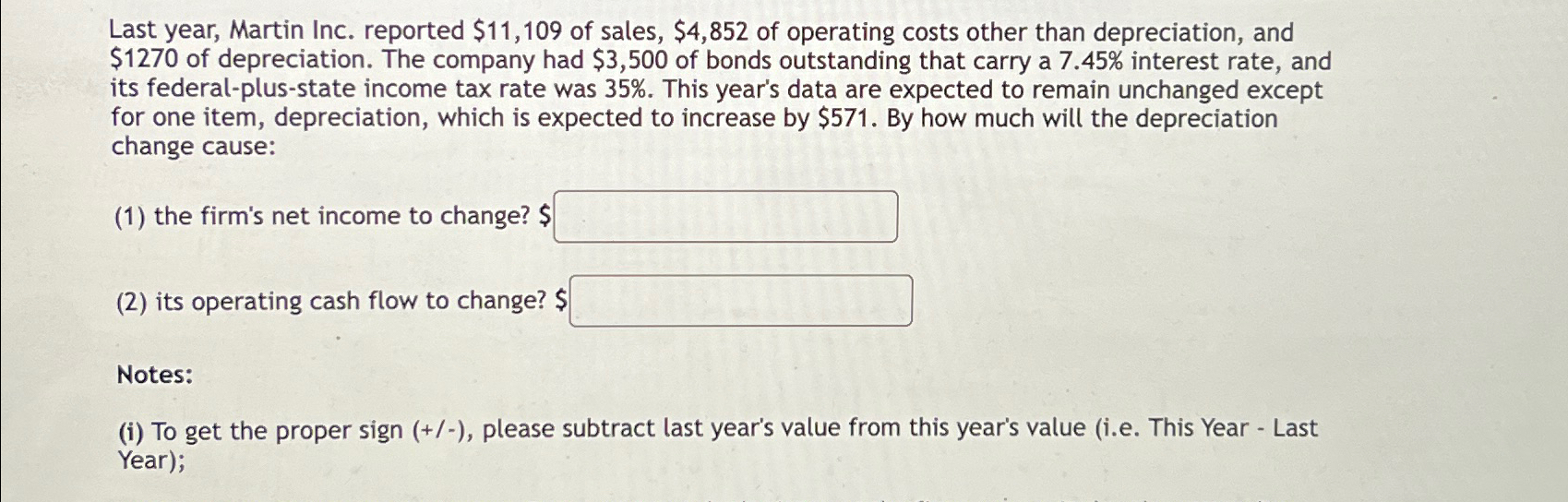

Question: Last year, Martin Inc. reported $ 1 1 , 1 0 9 of sales, $ 4 , 8 5 2 of operating costs other than

Last year, Martin Inc. reported $ of sales, $ of operating costs other than depreciation, and $ of depreciation. The company had $ of bonds outstanding that carry a interest rate, and its federalplusstate income tax rate was This year's data are expected to remain unchanged except for one item, depreciation, which is expected to increase by $ By how much will the depreciation change cause:

the firm's net income to change? $

its operating cash flow to change? $

Notes:

i To get the proper sign please subtract last year's value from this year's value ie This Year Last Year;

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock