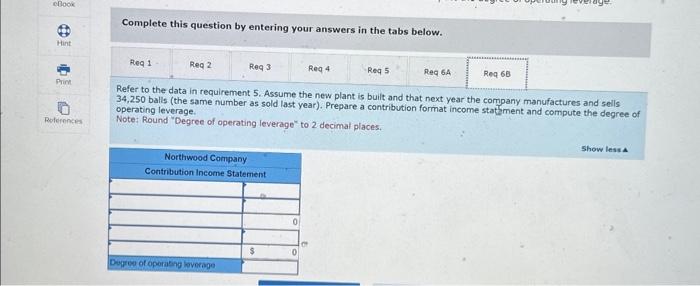

Question: last year). Prepare a contribution format income statement and compute the degree of operating leverage. Complete this question by entering your answers in the tabs

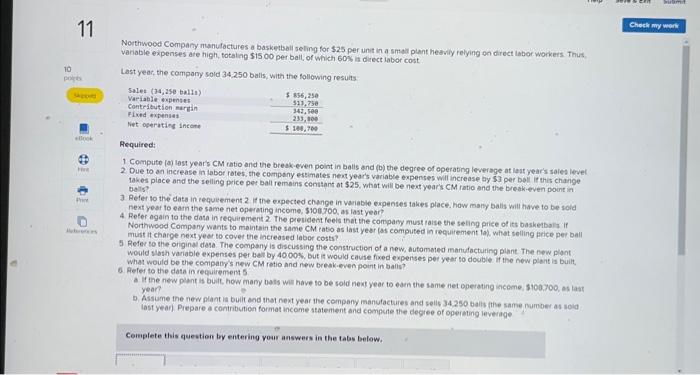

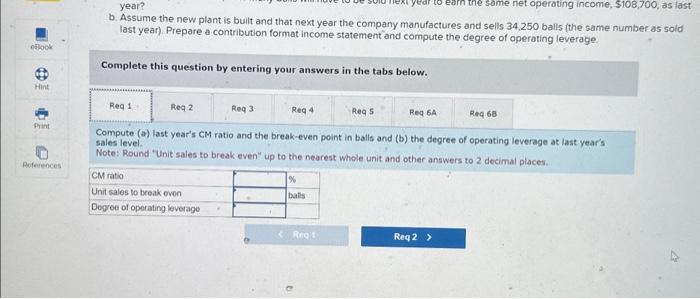

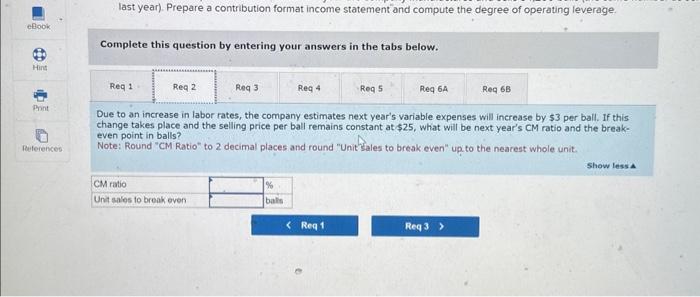

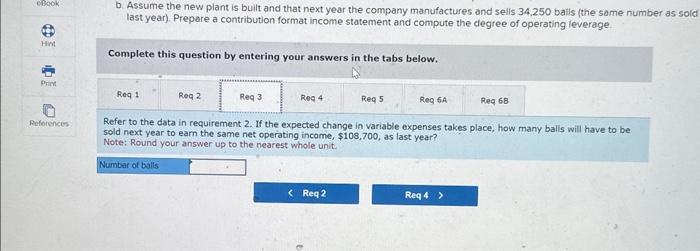

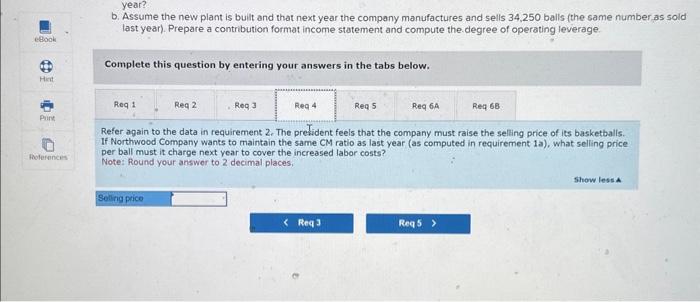

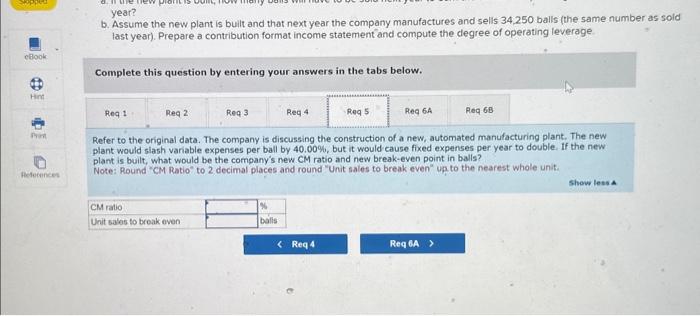

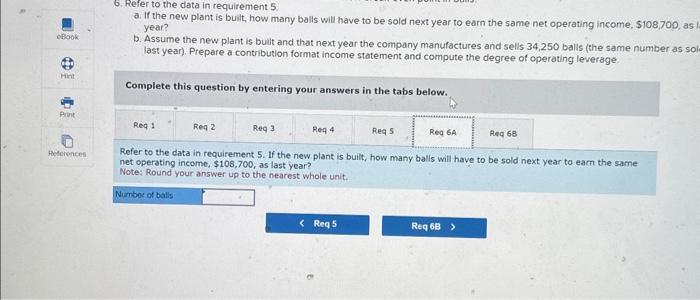

last year). Prepare a contribution format income statement and compute the degree of operating leverage. Complete this question by entering your answers in the tabs below. Due to an increase in labor rates, the company estimates next year's variable expenses will increase by $3 per ball. If this change takes place and the selling price per ball remains constant at $25, what will be next year's CM ratio and the breakeven point in balls? Note: Round "CM Ratio" to 2 decimal places and round "Unit "Slales to break even" up to the nearest whole unit. Complete this question by entering your answers in the tabs below. Refer to the data in requirement 5. Assume the new plant is built and that next year the company manufactures and seils 34,250 balls (the same number as sold last year). Prepare a contribution format income statement and compute the degree of operating leverage. Note: Round "Degree of operating leverage" to 2 decimal places. Northwood Company munufactures a basketball seling for $25 per unit in a smal punt heavily relying on direct labor workers thus. varable expenses are high, fotaling $1500 per ball, of which 60% is direct latoor cost tast year, the campany sold 34.250 balls, with the following results. Required: 1 Compute (a) lost year's CM catio and the break-even point in balis and (o) the degree of operabing ieverage at last years sales level 2 Due to on increase in labor rotes, the compony estimates next year's variable expenses wil increase by $3 per bol ir this change takes place and the selling price pet ball remeins conttant at $25, what will be next year's CM ratio and the break-even point in bells? 3. Refer to the data in requirement 2 if the expected change in variable expenses takes place. haw many balls will have to be scla next year to earn the same net operating income, $100700, as last year? 4. Refer again to the data in recuirement 2 The president feeis that the company must rase the seling price of iss basketbals if Northwood Company wants to meintain the same CM tatso as last year (as computed in requirement lah, what selling price per ball must it charge next year to cover the increased labor costs? 5 Refer to the original dasa. The company is discussing the construction of a new, autometed manufacturing plant. The new plant. would slath variable expenses per beil by 4000S, but it would cause foxed expenses per year to double if the new plant is built, What would be the company's new CM retio and new break-even point in balis? 6 . Reler to the data in requirement 5 a it the new pant is bult, how many bals war have to be sold next year to earn the same net eperating income, 5100700 , as last. year? b. Assume the new plant ia buil and thet next year the company manufactires and sells 34.250 balis fthe same number as soid last yeari Prepare a contribution format income statement and compcite the degree of opeinting leverage a. If the new plant is built, how many balls will have to be sold next year to earn the same net operating income, $108,700, as year? b. Assume the new plant is butit and that next year the company manufactures and selis 34,250 balls (the same number as s. last year). Prepare a contribution format income statement and compute the degree of operating leverage Complete this question by entering your answers in the tabs below. Refer to the data in requirement 5 . If the new plant is built, how many balls will have to be sold next year to eam the same net operating income, $108,700, as last year? Note: Round your answer up to the nearest whole unit. b. Assume the new plant is built and that next year the company manufactures and sells 34.250 balls (the some number as s last year). Prepare a contribution format income statement and compute the degree of operating leverage. Complete this question by entering your answers in the tabs below. Refer to the data in requirement 2 . If the expected change in variable expenses takes place, how many balls will have to be sold next year to earn the same net operating income, $108,700, as last year? Note: Round your answer up to the nearest whole unit. b. Assume the new plant is built and that next year the company manufactures and sells 34,250 balls (the same number as sold last year). Prepare a contribution format income statement and compute the degree of operating leverage. Complete this question by entering your answers in the tabs below. Compute (a) last year's CM ratio and the break-even point in balls and (b) the degree of operating leverage at last year's sales level. Note: Round "Unit sales to break even" up to the nearest whole unit and other answers to 2 decimal places. b. Assume the new plant is buil and that next year the company manufactures and sells 34,250 balls (the same number as solc last year). Prepare a contribution format income statement and compute the degree of operating leverage. Complete this question by entering your answers in the tabs below. Refer again to the data in requirement 2 . The prefident feels that the company must raise the selling price of its basketbalis. If Northwood Company wants to maintain the same CM ratio as last year (as computed in requirement 1a), what selling price per ball must it charge next year to cover the increased labor costs? Note: Round your answer to 2 decimal places, year? b. Assume the new plant is built and that next year the company manufactures and sells 34,250 balls (the same number as soid last year). Prepare a contribution format income statement and compute the clegree of operating leverage Complete this question by entering your answers in the tabs below. Refer to the original data. The company is discussing the construction of a new, automated manufacturing plant. The new plant would slash variable expenses per ball by 40.00%, but it would cause fixed expenses per year to double. If the new plant is built, what would be the company's new CM ratio and new break-even point in balls? Note: Round "CM Ratio" to 2 decimal places and round "Unit sales to break even" up to the nearest whole unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts