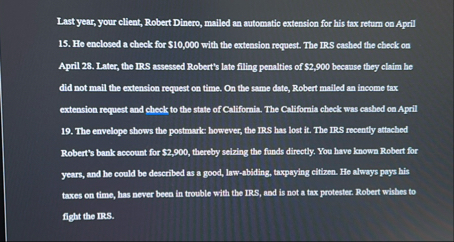

Question: Last year, your client, Robert Dinero, mailed an automatic extension for his tax returm on April 1 5 . He encloged a check for $

Last year, your client, Robert Dinero, mailed an automatic extension for his tax returm on April He encloged a check for $ with the extention roqpest. The IRS cashed the check on April Later, the IRS assessed Robert's late filling penalties of $ becaase they claim he did not mail the extension roquest on time. Oa the same date, Robert mailed an income tax extension request and check to the state of Califomil. The Callifomia check was eashed onApril The eavelope shows the postmarke however, the IRS has lost it The IRS recently attached Robert's bank aceount for $ thereby seizing the fands directly. You have known Robert for years, and he could be described as a good, lawabiding, taxpaying elthen. He alwoys prys his taxes on time, has never been in trouble with the IRS, and is not a tux protester. Robert wishes to fight the IRS.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock