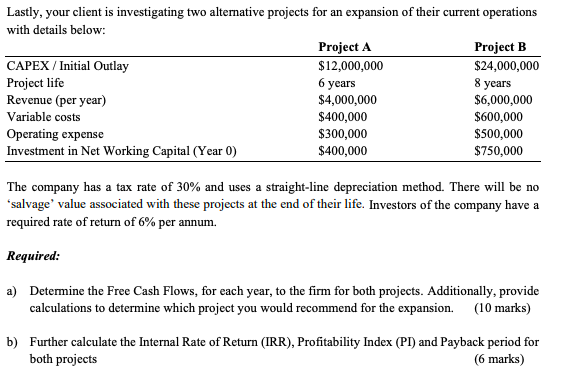

Question: Lastly, your client is investigating two alternative projects for an expansion of their current operations with details below: Project A $12,000,000 Project B $24,000,000 CAPEX

Lastly, your client is investigating two alternative projects for an expansion of their current operations with details below: Project A $12,000,000 Project B $24,000,000 CAPEX / Initial Outlay Project life 6 years 8 years Revenue (per year) $4,000,000 $6,000,000 Variable costs $400,000 $600,000 Operating expense $500,000 $300,000 $400,000 Investment in Net Working Capital (Year 0) $750,000 The company has a tax rate of 30% and uses a straight-line depreciation method. There will be no 'salvage' value associated with these projects at the end of their life. Investors of the company have a required rate of return of 6% per annum. Required: a) Determine the Free Cash Flows, for each year, to the firm for both projects. Additionally, provide calculations to determine which project you would recommend for the expansion. (10 marks) b) Further calculate the Internal Rate of Return (IRR), Profitability Index (PI) and Payback period for both projects (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts