Question: Layout References Mailings Review View Help fulfiles from the Internet can contain Viruses. Unless you need to edit, it's safer to stay in Protected View

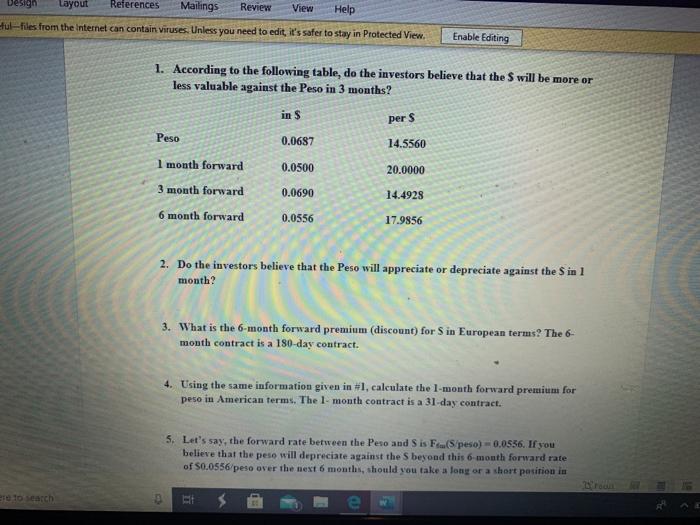

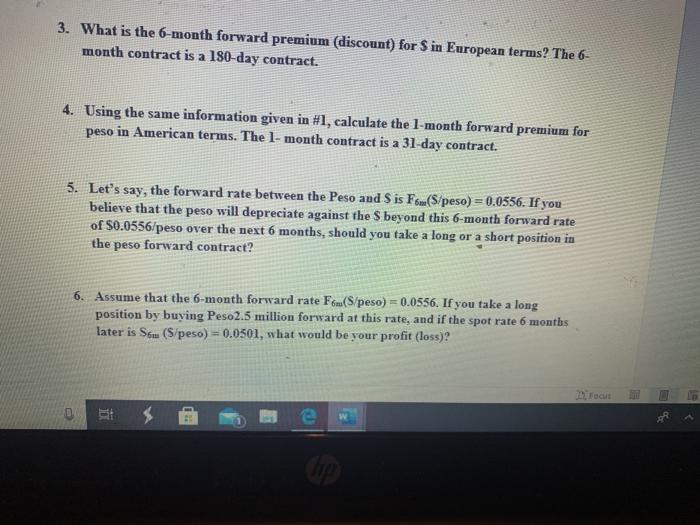

Layout References Mailings Review View Help fulfiles from the Internet can contain Viruses. Unless you need to edit, it's safer to stay in Protected View Enable Editing 1. According to the following table, do the investors believe that the S will be more or less valuable against the Peso in 3 months? in S per S Peso 0.0687 14.5560 1 month forward 0.0500 20.0000 3 month forward 0.0690 14.4928 6 month forward 0.0556 17.9856 2. Do the investors believe that the Peso will appreciate or depreciate against the Sin 1 month? 3. What is the 6-month forward premium (discount) for S in European terms? The 6- month contract is a 180-day contract. 4. Using the same information given in #1, calculate the 1 month forward premium for peso in American terms. The 1-month contract is a 31-day contract. 5. Let's say, the forward rate between the Peso and Sis Fru(S/peso) - 0.0556. If you believe that the peso will depreciate against the S beyond this 6 month forward rate of 50.0556/peso over the next 6 months, should you take a long or a short position in 25 ron e to search e 3. What is the 6-month forward premium (discount) for $ in European terms? The 6- month contract is a 180 day contract. 4. Using the same information given in #1, calculate the l-month forward premium for peso in American terms. The l-month contract is a 31-day contract. 5. Let's say, the forward rate between the Peso and Sis Fon(Stpeso) = 0.0556. If you believe that the peso will depreciate against the $ beyond this 6-month forward rate of $0.0556/peso over the next 6 months, should you take a long or a short position in the peso forward contract? 6. Assume that the 6-month forward rate Fu(S/peso) = 0.0556. If you take a long position by buying Peso 2.5 million forward at this rate, and if the spot rate 6 months later is Som (S/peso) - 0.0501, what would be your profit (loss)? Focus D RE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts