Question: LD Page view A Read aloud y Draw Highlight Question 3 Top Glove Corporation intends to invest $600,000 in Project Knight or Project Castle as

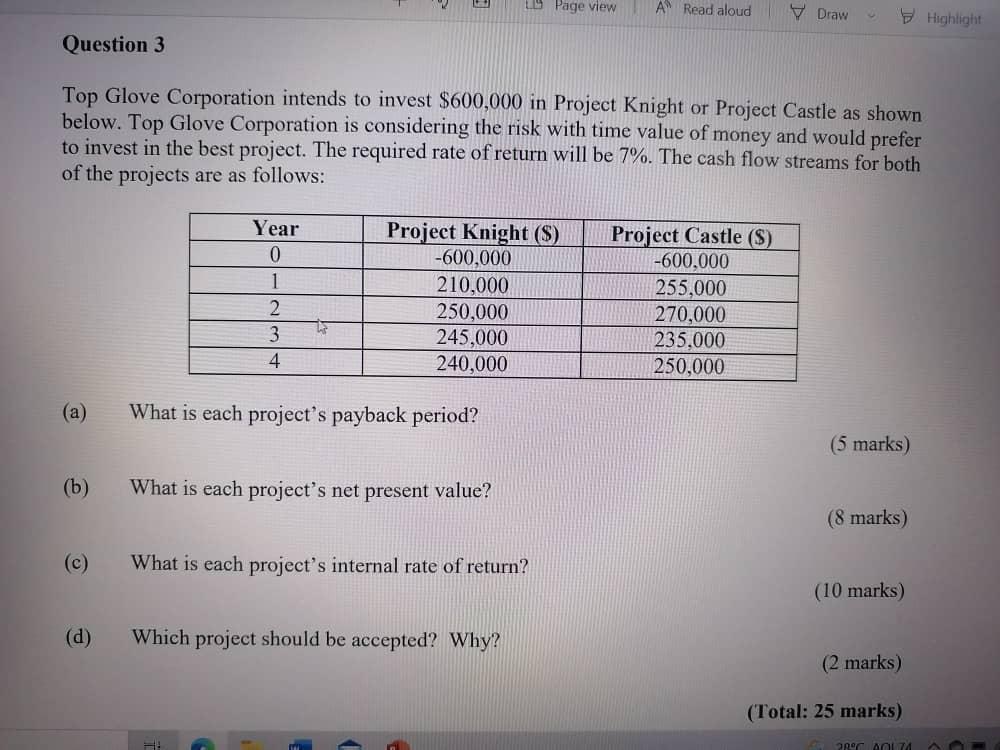

LD Page view A Read aloud y Draw Highlight Question 3 Top Glove Corporation intends to invest $600,000 in Project Knight or Project Castle as shown below. Top Glove Corporation is considering the risk with time value of money and would prefer to invest in the best project. The required rate of return will be 7%. The cash flow streams for both of the projects are as follows: Year 0 1 2 3 4 Project Knight ($) -600,000 210,000 250,000 245,000 240,000 Project Castle (S) -600,000 255,000 270,000 235.000 250,000 (a) What is each project's payback period? (5 marks) (b) What is each project's net present value? (8 marks) (C) What is each project's internal rate of return? (10 marks) (d) Which project should be accepted? Why? (2 marks) (Total: 25 marks) 289 ALTO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts