Question: le 2 pode 30 es 22. Suppose the current spot rate for Japanese Yen is 50.0125. The US inflation rate is expected to fall compared

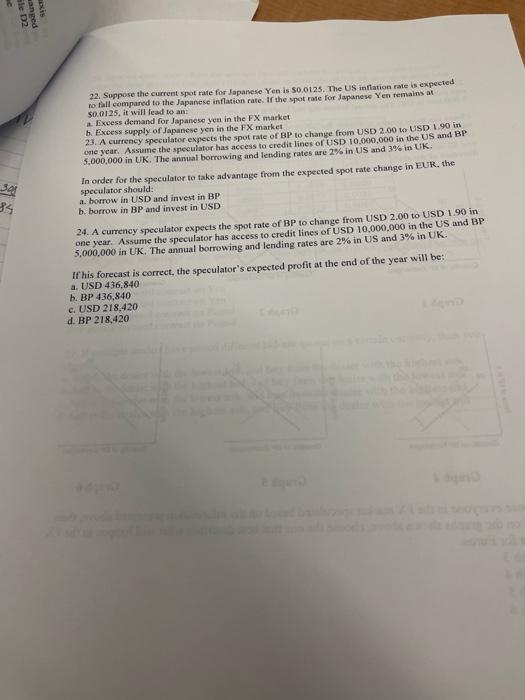

le 2 pode 30 es 22. Suppose the current spot rate for Japanese Yen is 50.0125. The US inflation rate is expected to fall compared to the Japanese inflation rate. If the spot rate for Japanese Yen remains al $0.0125, it will lead to an a Excess demand for Japanese yen in the FX market b. Excess supply of Japanese yen in the FX market 23. A currency speculator expects the spot rate of BP to change from USD 2.00 to USD 1.90 in one year. Assume the speculator has access to credit lines of USD 10,000,000 in the US and BP 5,000,000 in UK. The annual borrowing and lending rates are 2% in US and 3% in UK In order for the speculator to take advantage from the expected spot rate change in EUR, the speculator should a borrow in USD and invest in BP b. borrow in BP and invest in USD 24. A currency speculator expects the spot rate of BP to change from USD 2.00 to USD 1.90 in one year. Assume the speculator has access to credit lines of USD 10,000,000 in the US and BP 5,000,000 in UK. The annual borrowing and lending rates are 2% in US and 3% in UK If his forecast is correct, the speculator's expected profit at the end of the year will be: a. USD 436,840 b. BP 436,840 USD 218,420 d. BP 218,420

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts